AI isn’t just a tech story now. It’s a balance-sheet story

Three years after ChatGPT lit the fuse, the AI trade is graduating from narrative to underwriting.

At a glance

The market’s question has shifted from “is AI real?” to “can returns justify the bill?”

Two fault lines are emerging:

Access to capital (who can keep funding losses, and on what terms)

Capex gravity inside public markets (data centers consume cash; debt has a clock; depreciation lingers)

Our view: 2026 will be less about adoption (it will happen) and more about ROI visibility vs. tightening funding conditions

We’re watching three tells:

Credit spreads / financing terms for builders (not just buyers)

Evidence of unsubsidized pay-per-use demand that scales

Depreciation-driven margin pressure inside hyperscalers

The trade is entering the “rubber meets the road” phase

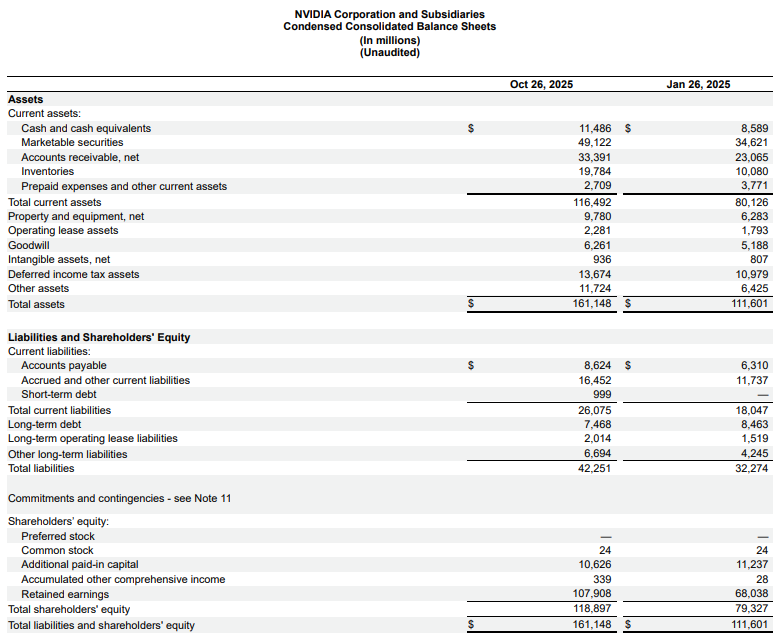

Three years after ChatGPT ignited the AI boom, the market is starting to ask the uncomfortable question: not “is AI real?” but “can the returns justify the bill?” Recent price action is sending mixed signals. A pullback in Nvidia, Oracle’s sharp drop after another step-up in AI capex, and growing skepticism around OpenAI-linked names are all reminders that the trade is moving from a narrative bull market into a cash-flow and balance-sheet test.

With the S&P 500’s multi-year rally heavily driven by mega-cap tech and AI infrastructure beneficiaries, the 2026 debate is becoming binary: de-risk ahead of a bubble unwind, or double down into the next leg of a genuine platform shift. The answer will depend less on adoption curves and more on capital cycles.

Thesis: AI is no longer just a software story — it’s a balance-sheet story

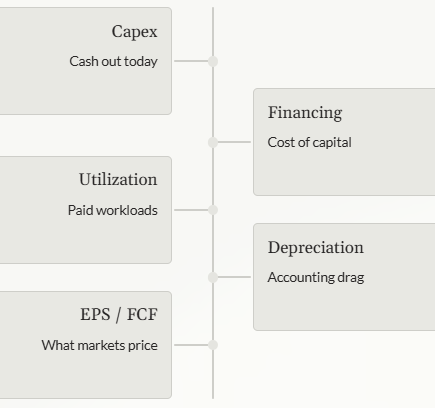

AI is increasingly being priced like infrastructure. That changes the game. Infrastructure builds are dominated by three forces:

Up-front capex

Financing structure and cost of capital

Utilization ramp (how fast the asset earns its keep)

The core question isn’t whether the technology works — it does. The question is whether enough of the ecosystem can fund the buildout long enough to reach stable, self-funding unit economics before capital conditions tighten.

Fault line #1: Access to capital (and the “circular” financing critique)

The first fault line is access to capital. Reports suggest OpenAI’s spending ambitions are enormous relative to current revenue, implying years of cash burn before self-funding. That has worked so far because capital has been abundant: large strategic checks, mega-rounds, and vendor/customer financing structures that increasingly look “circular” to skeptics.

If investor willingness to fund losses wanes, the stress would likely transmit quickly to the broader ecosystem — especially GPU/cloud intermediaries and data-center builders that rely on continuous external financing.

What to watch (testable, without guessing numbers)

Funding conditions / appetite

Down-round frequency, structured equity prevalence, and investor terms (liquidation prefs, ratchets)

Concentration risk: how much funding is coming from a small set of strategics

Builder financing terms (the market’s “truth serum”)

Credit spreads for the builders (and any trend of widening vs broader IG/HY)

Debt structure changes: shorter maturities, tighter covenants, higher secured issuance

Project finance signals: higher equity requirement, stricter DSCR assumptions, delayed drawdowns

“Circularity” stress markers

Vendor financing dependency (how much demand is pulled forward by financing rather than end-use)

Contract quality: cancellation clauses, minimum-commit duration, and pricing step-downs

Memo: If the funding window narrows, the first cracks show up in builder financing terms, not in AI adoption headlines.

Fault line #2: Capex gravity inside public markets

The second fault line is capex gravity inside public markets. Big Tech is projected to keep pushing hundreds of billions into data centers over the next year, but AI revenue is still lagging the cost curve. Oracle became a clean case study: bookings can look great, but data centers demand cash — often financed with debt — and debt has a clock.

When capex surprises higher and revenue growth misses, equities re-rate fast, and credit markets start speaking louder.

The slow-moving pressure point: depreciation

Rising depreciation from the data-center buildout is the slow-moving pressure point. What looks like growth investment today becomes a persistent drag on reported earnings tomorrow if utilization and monetization don’t ramp fast enough.

Depreciation is particularly unforgiving because:

It doesn’t care about narrative

It accumulates quarter after quarter

It can compress margins even while revenue grows — if the denominator isn’t scaling fast enough

What to watch (again: measurable, not speculative)

Capex realism

Capex-to-revenue trend for hyperscalers and major builders

FCF margin trend (is AI expanding or compressing cash generation?)

Depreciation drag

D&A as % of revenue and its rate of change

Operating margin vs. gross margin divergence (a signal of opex + D&A pressure)

Utilization & monetization

Evidence that capacity is filling with paying workloads (not just internal experiments)

Pricing discipline: stable or improving unit economics vs discounting to drive utilization

Memo: In this regime, depreciation is the silent tax — if utilization doesn’t ramp, margins compress even when revenue grows.

Oracle as a case study: when bookings meet the cash register

Oracle highlighted the new sequencing risk:

Demand signals can look strong (bookings, commitments, pipeline)

But capex commitments hit immediately (construction, power, GPUs, networking)

Financing structure matters (debt, leases, partners) — and debt has a schedule

If utilization lags or monetization disappoints, the market stops paying for “future ROI” and starts pricing the balance sheet today

This is why the next phase of the AI trade won’t be evenly distributed. The winners won’t just be the best storytellers. They’ll be the best underwriters.

Our view: from narrative bull market to underwriting test

This is evolving from a “narrative bull market” into a capital-cycle and underwriting test. The key variable for 2026 isn’t whether AI adoption continues (it will), but whether ROI visibility improves before funding conditions tighten.

If ROI visibility doesn’t inflect, the trade can still work — but it likely rotates from “everyone wins” to “only the best underwriters survive.”

The 2026 scoreboard: three tells that matter more than headlines

1) Credit spreads / financing terms for the builders (not just the buyers)

Are builders paying more for money than last quarter? Are maturities shortening?

Are lenders demanding more collateral, tighter covenants, or higher equity cushions?

Do financing terms improve only for the strongest credits (early sign of stratification)?

2) Real pay-per-use demand that scales without subsidy

Do customers expand usage at stable pricing, or only with discounts/credits?

Does “trial” convert to “production” workloads?

Do workloads persist (retention) or churn after promo periods?

3) Depreciation-driven margin pressure inside hyperscalers

Is D&A accelerating faster than revenue?

Are margins compressing even as top-line grows?

Does management guide to a path where utilization offsets depreciation — with credible milestones?

What this implies (positioning without pretending to know the outcome)

The S&P 500 can still rally on AI — but the internal leadership is likely to narrow. In the next regime, the market will reward:

Balance-sheet durability (funding resilience)

Monetization clarity (repeatable pay-per-use economics)

Underwriting discipline (capex that matches utilization ramp)

And it will punish:

High capex + weak ROI visibility

Reliance on “circular” financing structures

Margin stories that can’t outrun depreciation

Bottom line

AI adoption will continue. The question is whether ROI visibility arrives before the funding window narrows. If it does, the platform shift narrative will be reinforced. If it doesn’t, the market won’t abandon AI — it will simply reprice who gets to own the trade.