$NRG: Selling “Not Blacking Out” (Not Just kWh)

$NRG is building a two-sided flexibility platform – dispatchable supply + C&I demand response – at a defensible multiple.

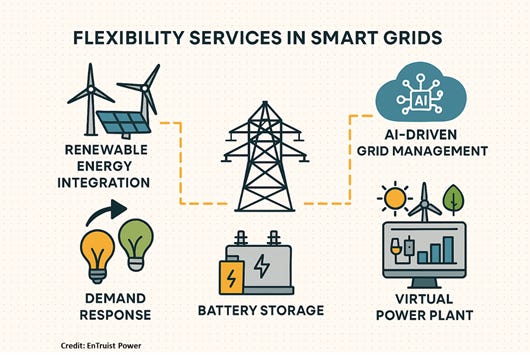

1) Why Grid Flexibility Wins Now

Power markets are quietly repricing what “value” means. For decades, the business was largely about selling energy volume (kWh). Increasingly, the scarce product is reliability and flexibility – being available when the grid is tight, responding fast when conditions change, and managing peaks that drive the system’s real stress. AI and advanced manufacturing are accelerants, but the durable driver is simpler: tighter reserve margins, higher volatility, and a grid that needs more “shock absorbers” than it used to.

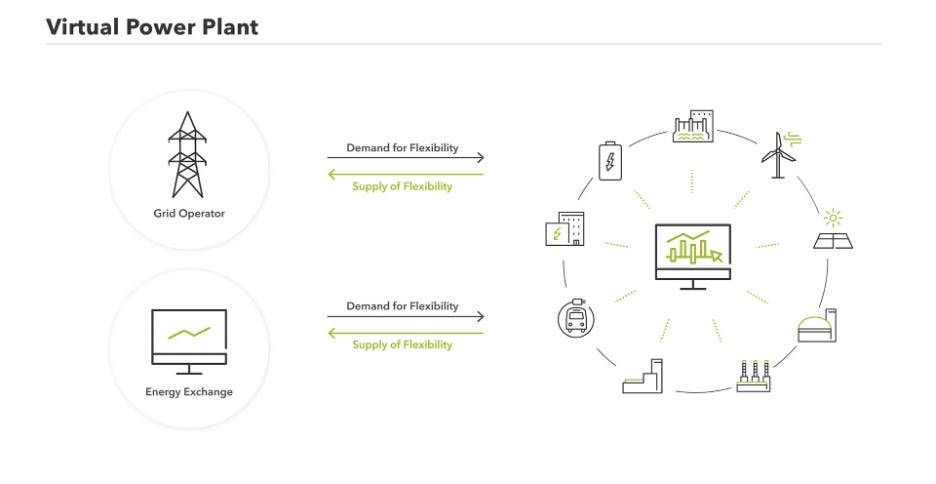

The easiest way to see this shift is to look at where capital and forecasts are clustering: virtual power plants (VPPs), demand response, and broader flexibility enablers. Market size estimates vary (definitions differ), but the direction is consistent—high growth off a relatively small base. One widely cited forecast pegs the global VPP market at $6B in 2025 growing to almost $31B by 2033 (about 22.6% CAGR), Beyond market-size estimates, some research suggests VPPs could cover 20%+ of U.S. peak demand by 2030, highlighting why flexibility is increasingly monetizable.

The punchline for investors is straightforward: if the grid increasingly pays for “being ready” and “responding quickly,” then platforms that can reliably deliver flexibility - across both supply and demand—should compound value even when headline narratives rotate.

2) NRG’s Flexibility Platform: What Changed and Why It Matters

NRG’s story is not that it discovered the grid is tight. The story is that it just scaled into a structure that can monetize tightness from both sides of the meter.

The hard catalyst is the LS Power transaction. On Jan 30, 2026, NRG announced it completed the acquisition of ~13 GW of power generation plus CPower, a commercial-and-industrial demand response / VPP platform. LS Power described the sale as a roughly $13B deal (cash plus NRG stock). Post-close, NRG said its generation fleet totals roughly ~25 GW.

CPower is the “demand-side” engine in that configuration. When the transaction was announced, NRG described CPower as operating across U.S. deregulated markets with roughly ~6 GW of capacity and 2,000+ commercial and industrial customers—scale that matters because flexibility is a volume game: aggregation, dispatchability, and repeatability tend to improve with size.

Here’s the investable logic in plain terms. NRG can now monetize reliability and volatility using two levers:

Supply-side dispatchability: flexible gas generation can ramp into scarcity and capture spreads when the grid is stressed.

Demand-side flexibility: demand response/VPP can curtail or reshape load when that is the cheaper (or more reliable) lever.

That two-sided optionality is not just operationally elegant - it has valuation implications. Platforms that can choose the cheapest lever in real time often exhibit (a) better resilience across regimes and (b) more ways to win when conditions tighten. In a world where the grid increasingly pays for flexibility, NRG is building what we’d call a “flexibility cash-flow machine”: multiple revenue pools (energy spreads, capacity, ancillary services, DR/VPP program payments, retail margin), with more internal hedging than a single-thread merchant generator.

The key is that none of this requires heroic assumptions about AI. AI-driven load growth can be upside, but the base thesis is simpler: the system is paying more for flexibility, and NRG just bought scale in both the asset and customer aggregation layers that deliver it.

3) Valuation & Comparison: What You Pay vs What You Get

A good narrative is necessary – but not sufficient – for a forward valuation piece. The question is whether you’re paying a “story multiple” or a “business multiple.”

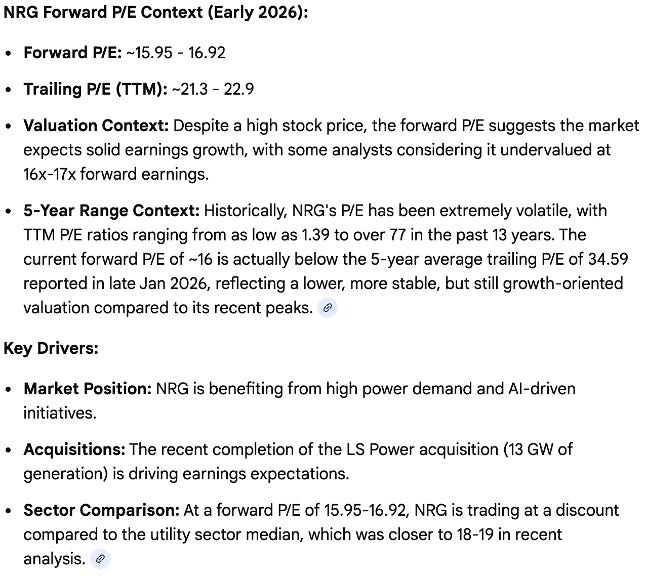

On that front, NRG looks notably more defensible than the crowded, high-multiple trades that require perfection. Depending on the screen and timestamp, NRG’s forward P/E is typically cited in the mid-to-high teens (examples include ~17.6x on a Yahoo quote snapshot, and ~15–16x in recent finance commentary that references forward valuation).

Street targets also suggest there’s room between price and consensus expectations. One MarketBeat compilation (Jan 19, 2026) cites 16 brokerages with an average 12-month price target of ~$199.21, and other aggregators commonly place the median/average target in the high-$180s to low-$200s range. You don’t need to worship price targets, but they are useful as a sanity check: the setup is not “everyone already agrees and it’s fully priced.”

For comps, we like using Vistra ($VST) as the closest reference point because investors often bucket these names together as competitive power platforms that can monetize volatility (with different mixes and exposures). Vistra’s forward P/E is also cited around the mid-teens on at least one forward-P/E screen, which helps frame that NRG’s valuation is not obviously “expensive” for the quality/optionality you’re buying.

The difference is not in a single metric – it’s in the platform architecture: NRG is explicitly combining generation dispatch with a scaled C&I demand-response aggregator under one roof.

In Base/Bull terms (kept deliberately simple): the Base case is that integration executes and flexibility revenue pools normalize without retail margin impairment; the Bull case is that CPower scales faster than consensus and the market re-rates NRG toward a “flex platform” multiple rather than a legacy generator/retailer framing. The three sensitivities that matter most – and that we’d watch explicitly – are (1) power volatility / spark spreads, (2) capacity pricing and reliability events, and (3) load growth and peak intensity (AI/industrial as accelerant, not the thesis).

4) Triggers to Watch

The next 6–18 months should be readable, not mystical. The first few post-close quarters are where NRG needs to prove that “two-sided flexibility” is not a slide-deck concept but a repeatable earnings engine. We would focus on (a) management’s integration proof points and guidance cadence, (b) any disclosed CPower operating metrics (managed MW growth, customer adds, program wins), and (c) capital return actions that remain consistent with balance-sheet discipline. MarketBeat’s compilation also references a $3.0B buyback authorization; when you draft the final piece, it’s worth verifying the exact authorization language and timing from company filings/earnings materials and then using it as a hard capital-return anchor.

A bull case is only as good as its kill switches. For NRG, the risks aren’t vague “integration issues”—they are specific, trackable metrics that could trigger a 20%+ drawdown if they flash red. If you see these three things happen, the “flexibility platform” story is broken:

The “Thermostat Revolt” (VPP Execution Risk): The entire Virtual Power Plant (VPP) thesis hinges on Vivint customers letting NRG throttle their AC during a Texas heatwave. This is a social risk, not a tech risk. In past summers, Texans revolted when they “woke up sweating” due to remote adjustments, leading to mass un-enrollments. We would suggest watch the Vivint attrition rate during the next few earnings call,

The Regulatory “Rug Pull” (PCM & Price Caps): NRG is betting on Texas (PUCT) paying them “reliability premiums.” However, regulators recently shelved the $1B Performance Credit Mechanism (PCM) due to cost concerns. Since 2026 is an election year for Texas state officials, there is a massive incentive for the PUCT to artificially suppress prices if voters complain about bills.

The 4.5x Leverage Trap (Credit Risk): To swallow LS Power, NRG took on significant debt. S&P Global is currently watching their leverage like a hawk.If the Net Debt-to-EBITDA ratio creeps above 4.5x in Q1 or Q2 earnings. A downgrade to “Junk” (High Yield) territory would force institutional selling and spike NRG’s interest costs, killing the capital return (buyback) story.

Bottom line: NRG is not a meme stock – it’s a scale operator aiming to turn grid stress into cash flow. With a defensible forward multiple in the mid-to-high teens and a Street target set that often implies meaningful upside, the risk/reward is attractive on disciplined entries – conditional on execution. We are long-term bullish: the grid’s willingness to pay for flexibility is structural, and NRG is now built to monetize that trend at scale.