PickAlpha Forward Valuation – Tesla (TSLA)

Is Tesla Still an EV Stock – or the First Public AI Robot Platform?

Introduction – What This Note Is (and Isn’t)

This is not a “Tesla is worth $X” piece.

If you follow the stock, you’ve already seen every version of that: Tesla as a broken EV story, Tesla as a clean-energy compounder, Tesla as a proto–AI and robotics platform. All of those narratives have elements of truth. None of them, on their own, are very useful when you’re trying to decide what to do with an actual position across real-time horizons.

The goal of PickAlpha Forward Valuation is different. For a single name, we build a forward map instead of a single target: a small set of explicit future states (Bear / Base / Bull), a realistic 3-to-5-year business mix for each, and a concrete list of dated events and milestones that shift the probability between them. Then we layer on a strategy menu by horizon so you can translate that map into decisions: how big you want to be, over what time frame, and what kind of risk you’re really underwriting.

Tesla is the natural place to start this series. It sits at the junction of multiple debates that matter for the next decade: EV adoption and pricing power, the economics and regulation of autonomy, the viability of humanoid robots, and the role of in-house AI silicon. On top of that sits one of the most controversial pay packages in corporate history. Whether you love or hate Elon Musk, the combination of scale, volatility, and path-dependence makes TSLA a near-perfect test case for a forward valuation framework.

This note is written for readers who already know the ticker and most of the headlines. We’re not going to explain what a Model Y is. We’re going to ask three sharper questions instead:

What kind of company is Tesla trying to become over the next 3–5 years?

What are the realistic Bear / Base / Bull end-states for that journey, in business-mix and margin terms – not just in vibes?

Given the actual calendar of events between now and then, how should that influence the way you size and time a TSLA position?

Along the way, we’ll try very hard to separate what’s in the numbers today from what’s still optionality, and to be explicit when we move from facts to judgment. This is not investment advice, and we’re not optimizing for a viral hot take. The aim is something more practical: a repeatable, documented process you can revisit after each major Tesla milestone and ask, “Did this event really move the forward valuation map, or just the day’s narrative?”

Section 1

TL; DR and How to Use This Note

1.1 TL; DR – The Forward Map in One Page

Core debate -

Over the next 3–5 years, Tesla can credibly end up in three very different states:

Bear: a de-rated global auto + energy name with expensive AI/robotics side bets;

Base: a mixed EV, energy, and early autonomy platform where FSD and energy matter but don’t dominate;

Bull: a vertically integrated AI & robotics platform that just happens to sell a lot of EVs.

What really moves you between those states -

The probabilities don’t change because of memes; they change when dated events hit: Q4 2025 margins and mix, 2026 Cybercab and Optimus launches, and the 2027 rollout of Tesla’s AI5 chip into vehicles, robots, and data centers.

0–3 months (Q4 print + first robotaxi phase):

· If Q4 2025 shows volumes defended only via deeper price cuts and another margin step-down, treat strength as a chance to de-risk toward the Bear template.

· If Q4 margins stabilize, energy/storage accelerate, and FSD / software show up with real attach and ARPU numbers, lean Base: buy or add on dips back to pre-earnings valuation bands while watching early robotaxi safety and regulator reaction as a tie-breaker.

3–12 months (2026 launch year: Cybercab & Optimus):

· If Cybercab really starts production in 2026, appears on public roads without regulatory panic, and Optimus is quietly deployed inside Tesla factories with quantified productivity gains, keep a core long bias and fund a small “Bull sleeve” (e.g., structured upside) around major launch updates.

· If Cybercab slips or launches in a heavily watered-down form, and Optimus is still mostly a demo, treat AI/robotics rallies as exits back toward a Base sizing that assumes EV + energy + FSD matter, but robotaxis/robots are optionality, not core.

12–24 months (AI5, network scale, and the platform verdict):

· If by 2027 AI5 is shipping at scale, robotaxi networks are operating across multiple cities with improving unit economics, and Optimus has both internal and early external customers, you’re living much closer to the Bull world – deep macro-driven pullbacks are candidates to add to a structurally sized position, within hard risk limits.

· If AI5 keeps slipping, capex balloons into open-ended fab spending, and most earnings still depend on selling cars and Megapacks, anchor valuation squarely on EV + energy + FSD and size the name like a good cyclical with side bets, not like an AI platform.

The rest of the note fills in the scaffolding: how Tesla’s business pipeline and Musk’s incentives map into these scenarios, and how to turn that into a disciplined horizon-specific playbook.

1.2 How to Read This Note

If you only have three minutes, read the TL;DR above and skim the scenario summaries in Section 3. That will give you a working mental model for “which world we are in” whenever TSLA moves.

If you have 10–15 minutes, read Section 2 (“Background: Business Model, AI Pipeline, and Incentive Structure”) in full. That section is the input layer: it separates today’s business from the future bets, and explains why the business development pipeline (EVs, energy, FSD, robotaxis, Optimus, AI chips) and Musk’s pay and incentives are not gossip but direct valuation inputs.

If you care primarily about portfolio construction and tactics, focus on Sections 3 and 4:

Section 3 lays out the three forward valuation scenarios and describes what Tesla looks like in 3–5 years under each – what drives revenue, what margins and multiples look like in broad terms, and what kind of news pattern over the next two years would be consistent with that world.

Section 4 then turns those scenarios into a strategy menu by horizon: 0–3 months (Q4 print + first robotaxi phase), 3–12 months (the 2026 launch year for Cybercab and Optimus), and 12–24 months (AI5 rollout and the “platform verdict”). Each horizon has concrete “if [event pattern], then consider [template]” examples – not as recommendations, but as benchmarks for coherent thinking.

Two final housekeeping points:

We deliberately keep numbers in ranges and narratives, not single-point forecasts. Wherever you see brackets or bands, those are places where different investors can plug in their own models without breaking the overall framework.

This note is not investment advice, and it does not account for your personal risk tolerance, tax situation, or constraints. It is designed as a structured lens on TSLA’s forward path – a way to turn the constant trickle of Tesla headlines into a more testable, scenario-based process.

Section 2

Background: Business Model, AI Pipeline, and Incentive Structure

2.1 Where Tesla Is Today: Business Mix and Financial Baseline

Tesla started by proving that long-range EVs could be aspirational products, not compliance cars. The original top-down strategy – launching high-performance, high-priced models first and using the brand halo to fund mass-market vehicles – worked extraordinarily well. For years, Tesla effectively owned the U.S. luxury EV segment and at points even outsold established premium brands in aggregate.

Today, the business is broader and more complicated. Tesla designs, manufactures, and sells a full lineup of EVs (Model S/3/X/Y, Cybertruck, and the Semi), plus energy generation and storage products (solar, Powerwall, Megapack), and software like supervised Full Self-Driving (FSD). It also operates a global Supercharger network and sells home-charging solutions, making the ecosystem stickier than a pure OEM.

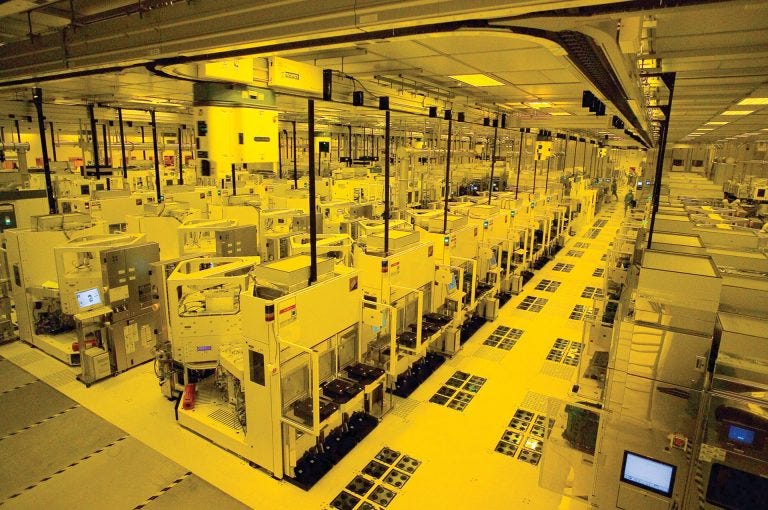

(Tesla Giga assembly line. Source: Tesla)

The revenue mix, however, is still dominated by automotive. In 3Q25, Tesla reported roughly $28.1B in revenue, up about 12% year on year. Automotive revenue grew a mid-single digit percentage, while energy generation and storage jumped more than 40%, reflecting record Megapack deployments. Free cash flow nearly reached $4B for the quarter, and Tesla carried about $42B in cash and investments against roughly $7.5B of total debt – an unusually strong balance sheet for a company still in heavy build-out mode.

The income statement tells a more nuanced story. Vehicle deliveries hit ~497k in the quarter, beating guidance and estimates, with particularly strong growth in Europe and select Asian markets. Yet net income fell about a third year on year, marking a fourth consecutive quarter of declining profit. Price cuts to defend volume against intensifying competition, plus rising operating expenses tied to AI, robotics, and new product programs, have compressed margins. The expiration of the U.S. EV tax credit in September 2025 is another near-term headwind for domestic demand into 2026.

For forward valuation, this baseline matters: Tesla is simultaneously a high-volume auto manufacturer under margin pressure and a capital-heavy growth story funding multiple new platforms.

2.2 From EV Maker to Multi-Pillar Platform: The Business Plan

Management’s message is that Tesla is no longer just “an EV company.” The forward business plan rests on several intertwined pillars:

Auto core and next-gen vehicles.

Tesla still sells most of its units through Models 3 and Y, with the Cybertruck and Model S/X as smaller contributors and the Semi in early stages. The company has explicitly discussed aspirations to reach roughly 3 million vehicles per year within the next 24 months. New variants, like the six-seat Model Y L in China (with a stretched wheelbase and captain’s chairs), target specific regional niches and suggest further tailoring of the lineup. A second-generation Roadster remains on the roadmap for late in the decade, albeit with repeated delays. All of this sits inside a more competitive EV landscape, with Chinese OEMs applying cost pressure from below and legacy automakers defending share at home.

Robotaxis and FSD.

On the autonomy side, Tesla has moved beyond promises to early commercial experiments. In 2025, it launched a robotaxi service in Austin using FSD-enabled Model 3s and Ys, some with safety drivers and some without. Management has flagged ambitions to scale that fleet toward roughly 1,500 robotaxis across Austin, the Bay Area, and potentially Arizona, Nevada, and Florida by the end of 2025, subject to regulatory approval. The dedicated Cybercab – a two-seat, no-steering-wheel, no-pedals vehicle unveiled in late 2024 – is meant to anchor this business longer term, with mass production currently targeted for 2Q26. In practice, that schedule is hostage to both software maturity and regulators’ tolerance for unsupervised operation.

(Tesla Cybercab robotaxi concept. Source: axios.com)

Optimus and robotics.

The humanoid robot program, Optimus, is another long-dated but central pillar. Tesla plans to unveil a new iteration of Optimus in early 2026 and has floated an internal target of building a line capable of producing up to one million units per year by the end of 2026. That is an aggressive ambition for a category that currently contributes no meaningful revenue. From a valuation standpoint, Optimus is pure optionality today – but the scale of capex and hiring around AI and robotics signals that management wants this to be a real business, not a marketing slide.

Energy and storage.

Energy generation and storage may be the least flashy but most “modelable” growth driver. Residential Powerwall and utility-scale Megapack shipments have grown rapidly, with energy revenue in 3Q25 outpacing the auto segment by a wide margin on a percentage basis. Storage sits at the intersection of EV charging, renewables, and AI data centers’ power needs. If margins normalize at reasonable levels, this segment can quietly compound and support free cash flow even if the more speculative bets take longer to pay off.

(Tesla Supercharger station at night. Source: InsideEVs)

The through-line across these pillars is clear: Tesla’s business plan is to compound the auto base while layering higher-margin, software- and AI-heavy streams (FSD, robotaxis, robotics, storage) on top. Whether the equity deserves an “auto” multiple or something closer to a platform multiple depends on how much of that plan investors believe will be real within their horizon.

2.3 AI Silicon as a Strategic Lever: AI5, AI6, and Vertical Integration

Underneath the product roadmap is a less visible but critical piece of the strategy: Tesla’s pivot to in-house AI silicon.

After years of experimenting with the Dojo training system and using a mix of Nvidia and internal hardware, Tesla has effectively consolidated around a unified architecture built on two chips: AI5 and AI6. Both are designed as high-performance inference chips to run autonomy and robotics workloads in real time, rather than as general-purpose training accelerators.

The design philosophy is “radical simplicity.” Musk has described AI5 as stripping out a long list of unnecessary components, resulting in a chip small enough to fit on a half reticle – roughly half the die size of certain leading data-center GPUs. Smaller dies allow more chips per wafer, potentially lowering cost per unit, and a simplified design should make it easier to adapt to multiple foundries’ processes. Internally, Tesla is targeting significantly better performance per watt and performance per dollar than off-the-shelf alternatives, with orders-of-magnitude improvements over its own prior generations.

On the manufacturing side, Tesla is spreading AI5 and AI6 across two heavyweight partners. TSMC is slated to fabricate AI5 on advanced nodes, with limited quantities expected as early as 2026 and volume production pushed into 2027. Samsung has signed a multi-year, multibillion-dollar agreement – on the order of tens of billions of dollars – to produce AI6, which is aimed at even higher-end autonomous and robotics workloads. Using two foundries in parallel is unusual and will require incremental design work, but it also reflects management’s view that a single supplier cannot meet Tesla’s potential demand for AI compute.

(Cleanroom of TSMC’s silicon factory. Source: TSMC)

Even with those partnerships, Musk has openly mused about building a massive internal fabrication plant – dubbed “Terafab” in some commentary – that could ultimately process hundreds of thousands of wafers per month. A facility of that scale would take years and tens of billions of dollars to bring online, even with government incentives, and would compete directly for capital with factories, robot fleets, and energy projects.

In practice, this silicon strategy has two important implications for forward valuation:

In the near term, it adds to capex and R&D intensity, which is already pressuring margins. The early waves of Cybercabs and Optimus units will likely ship before AI5 is in full volume, forcing Tesla to rely on a mix of Nvidia and legacy hardware longer than ideal.

Over the medium to long term, if AI5/AI6 and any in-house fabrication effort succeed, Tesla could own a differentiated cost and performance position in autonomy and robotics. That would support higher structural margins in the bull scenarios – but also raises the execution and balance-sheet risk if the chip bets do not pay off.

2.4 Musk’s Pay Package and Incentives: Governance as a Valuation Input

The other axis of Tesla’s forward story is more human: how Elon Musk is being paid, and what that implies for risk-taking.

Musk has long foregone a traditional cash salary at Tesla, instead relying on large, milestone-based option packages. The 2018 ten-year performance award tied his compensation entirely to meeting a ladder of market cap and operating targets, and for a time it looked like a case study in high-powered incentives. Tesla’s value increased by an order of magnitude, and many of the original milestones were met.

(Poster of Elon Musk on stage. Source: Tesla)

Courts saw the story differently. A Delaware judge ultimately rescinded the 2018 package, citing concerns about process and fairness rather than simply the headline dollar amount. The board and shareholders later voted to re-approve the award, but subsequent rulings have thrown that ratification into question, leaving a governance overhang that is not yet fully resolved.

Against that backdrop, Tesla has now floated an even more ambitious stock-based package that could be worth on the order of a trillion dollars if extreme goals are met, including building roughly a million humanoid robots and driving Tesla’s market cap toward the high single-digit trillions – roughly six times its current level. If fully realized, this structure would give Musk control of roughly a quarter of Tesla’s equity after taxes, effectively cementing his ability to dominate any shareholder vote.

Supporters argue that this is the price of keeping a uniquely ambitious founder focused on Tesla’s hardest problems. Critics, including some large institutional investors, question both the governance optics and the premise that incremental billions meaningfully change how Musk spends his time. Musk himself has suggested that what he cares most about is influence: he wants enough ownership to feel comfortable “building the robot army” under his own vision, and has hinted that he could shift his focus elsewhere if he does not get it.

For forward valuation, the key point is not whether the package is “fair” but what it telegraphs:

It structurally aligns Musk’s upside with extremely aggressive outcomes in robotaxis, Optimus, and AI infrastructure – a world in which Tesla looks more like a vertically integrated AI and robotics platform than an automaker.

It also widens the distribution of outcomes. Rich option packages and concentrated control can amplify overconfidence and risk-taking, especially when combined with capital-intensive projects like chip fabs and robot fleets.

In other words, the pay debate is really a debate about Tesla’s path: incremental EV and energy growth with manageable risk, or a higher-variance bet on multi-trillion-dollar AI and robotics ambitions. Our forward valuation map needs to respect both possibilities.

2.5 Interim Takeaways for the Forward Valuation Map

Pulling the threads together:

Core business: Tesla enters 2026 as a scaled, profitable EV and energy company with a strong balance sheet but pressured margins and growing competition.

Growth pillars: Robotaxis, FSD, Optimus, and energy storage are designed to push the mix toward higher-margin software and services, but most of that value is still in front of investors, not in current earnings.

AI silicon: The AI5/AI6 strategy adds capex and execution risk now in exchange for potential structural cost and performance advantages later.

Incentives: Musk’s evolving pay structure and desire for control make it more likely that Tesla will continue to pursue high-upside, high-variance projects in autonomy and robotics.

These elements define the edges of our forward valuation scenarios. In the next section, we translate them into explicit Bear, Base, and Bull cases – with approximate revenue mixes, margin profiles, and valuation bands – and build an event map that links upcoming headlines to those paths.

Section 3

Forward Valuation Scenarios

This section turns the background into three working states for Tesla’s future: a Bear case, a Base case, and a Bull case. These are not forecasts; they are maps. The goal is to have a concrete mental model for what Tesla looks like in 3–5 years under each path, and what kind of news over the next 12–24 months pushes us toward one case or another.

3.1 Bear – De-Rated Global Auto with Expensive Optionality

In the Bear case, the market ultimately treats Tesla as a good but pressured global EV manufacturer with some interesting side projects, rather than as a true AI or robotics platform. Three to five years out, most of the revenue still comes from selling cars and related services. Auto remains something like three-quarters or more of the top line; energy and storage are noticeable but not decisive, and software from FSD or early robotaxis is a small single-digit slice. Optimus and AI silicon are present mostly as R&D expense and slideware rather than scaled businesses.

The financial picture in this world reflects that mix. Auto margins are stuck in the low- to mid-teens as price cuts, competition from Chinese OEMs, and incentive roll-offs keep a lid on pricing power. Energy grows, but at margins that look more like industrial hardware than software. High, ongoing capex on AI, robotics, and chip projects prevents free cash flow from compounding cleanly, and the group settles into a high-single-digit or low-teens operating margin profile. The equity de-rates toward a “quality cyclical auto + energy” multiple: a modest premium to legacy OEMs, but nowhere near a software or platform valuation.

Over the next 12–24 months, headlines that push us toward this Bear state share a common pattern. Quarterly deliveries may still grow, but beats come only via more aggressive price cuts or cheaper trims, and gross margins disappoint consistently versus guidance. FSD attach rates plateau, and regulators slow-walk robotaxi approvals after well-publicized incidents. Optimus remains a factory demo rather than a meaningful productivity lever, and AI5/AI6 slip further to the right on the timeline without clear economic proof points. Governance stays noisy, with pay disputes and Musk side projects making it harder for large institutions to justify paying a premium multiple. In this environment, rallies tend to fade near historical valuation bands, and the risk is a grind lower whenever macro or competition headlines turn against the stock.

3.2 Base Case – Mixed EV, Energy, and Early Autonomy Platform

The Base case assumes Tesla successfully stabilizes the core auto business and steadily layers on higher-quality revenue streams, without yet proving the full robotaxi and robotics dream. Three to five years out, auto is still the largest segment but no longer the overwhelming majority of revenue – think roughly 55–65% of the mix. Energy and storage grow into a consistent mid-teens or low-20s percentage share, becoming a real free cash flow contributor. Software, FSD, and early autonomy economics account for a meaningful but not dominant 10–20% slice, as subscription attach and pricing improve. Robotics is small in absolute dollars, but there are visible pilots and internal deployments that look like the seeds of a business rather than a science project.

In this world, the margin and valuation profile look more like a hybrid between an efficient automaker and a capital-light software and energy company. Auto gross margins stop deteriorating and settle back into the mid-teens as mix and cost control offset competitive pressure. High-margin software and a healthier energy business allow group operating margins to move into the mid-teens and free cash flow margins into the low- to mid-teens. The market is willing to pay a clear premium to traditional OEMs because more of Tesla’s economics come from recurring software and infrastructure, but it still anchors on tangible cash flows rather than extrapolating a pure AI platform. Multiples in this state are above the Bear case, but not in the realm of the most richly valued software names.

The next 12–24 months tilt us toward this Base case when a few conditions line up. Deliveries and revenue generally meet or beat expectations without constant price fire-drills, and management’s commentary on margins gradually shifts from “pressure” to “stability.” FSD continues to roll out new capabilities, with attach rates and subscription revenue clearly trending up and forming a visible part of segment profit. Robotaxi experiments expand beyond one or two cities, even if they remain partially supervised, signaling a credible path to scale. Energy and storage show steady growth with improving margins, and earnings calls start to treat them as a core pillar rather than “other.” AI5/AI6 hit key design and early production milestones roughly on time, but the chip program is understood by the market as a medium-term cost and capability edge, not a near-term binary catalyst. Governance questions never fully disappear, yet major legal overhangs around pay and control are defused enough that they become background noise rather than front-page risk. In this Base world, the stock can live in a relatively wide but positive band: sell-offs toward “good auto + solid energy” valuation tend to attract buyers, while re-ratings require evidence that software and storage are consistently carrying more of the earnings load.

3.3 Bull – Vertically Integrated AI and Robotics Platform

The Bull case is the version of Tesla that most closely matches the company’s own rhetoric: an AI and robotics platform with an EV and energy base underneath, rather than the other way around. On a three- to five-year view, auto is still a large revenue line, but it may be only 35–50% of the mix. Software, FSD, and robotaxi services represent 20–30% of revenue, with subscription and network economics driving a disproportionate share of profits. Energy and storage maintain a mid-teens to mid-20s contribution, intertwined with data center and robot infrastructure. Robotics and automation – the Optimus program and related systems – move beyond pilots and are deployed at scale both inside Tesla and with external customers, contributing a high-growth 10–20% slice of revenue.

In this world, the financials reflect a structurally different business. A much larger portion of Tesla’s economics comes from software, autonomy, and automation, where incremental margins are high once the fixed R&D and capex are sunk. Group operating margins can move into the high-teens or better, and free cash flow conversion improves meaningfully, even as the company continues to invest heavily. If AI5/AI6 and any level of vertical integration succeed, Tesla owns a cost- and performance-advantaged compute stack tailored to autonomy and robotics, which protects those margins and raises barriers to entry. The market begins to value Tesla using a blended platform framework: applying tech- and software-style multiples to the autonomy and robotics streams while valuing auto and energy more conservatively. The absolute valuation in this state depends on interest rates and broader risk appetite, but it sits clearly above any reasonable auto-anchored framework.

To move credibly toward this Bull world over the next 12–24 months, the headlines have to change character. Robotaxi networks need to expand in a way that looks like a real business: multiple regions, growing ride volumes, improving unit economics, and regulators explicitly authorizing unsupervised operation in defined zones. FSD must cross from “advanced driver assist” into something closer to a de facto autonomy subscription in the eyes of both consumers and regulators, with safety and performance data backing that shift. Optimus has to show quantifiable productivity gains inside Tesla’s own factories and real pilots with external customers, not just impressive videos. AI5/AI6 need to hit public benchmarks that support the “best performance per watt and per dollar” narrative, and any Terafab-style fabrication plan must be framed as a disciplined, co-funded build rather than an open-ended vanity project. Governance must look like a feature, not a bug: Musk clearly focused on Tesla’s roadmap, legal overhangs contained, and the enormous pay package seen as tied to real outcomes rather than pure leverage. In that setting, the upside tail of the valuation distribution opens up – but the path is volatile, and any disappointment on autonomy, regulation, or execution can trigger sharp de-ratings even within an overall Bull trajectory.

3.4 Using the Scenario Map

Practically, this map is meant to be a living tool, not a static label. You can hold a Base-case view on Tesla but still acknowledge that certain events – say, a major robotaxi approval or a serious regulatory setback – move the probability weight toward Bull or Bear. You can also choose different strategy menus depending on which scenario you think is most likely and how quickly you expect the market to price it in.

For our purposes in this series, the rule of thumb is simple: when a Tesla headline hits the tape, we’ll ask two questions. First, “Which of these three worlds does this event make more likely?” Second, “Does that change our time horizon or risk sizing, or just the volatility between here and there?” The next section turns that into concrete strategy examples across different holding periods.

Section 4.

Strategy Menu by Horizon – From Headlines to Playable Setups

This section turns the scenario map into a concrete playbook across three investment horizons. The events are real, dated (or date-anchored), and directly connected to whether Tesla drifts toward our Bear, Base, or Bull world.

4.1 0–3 Months – Q4 Print and First-Phase Robotaxis (Now → late Feb 2026)

In the next three months, the two main tests are simple: how 2025 ends on paper, and whether early robotaxi operations look boring and safe or chaotic and noisy.

On the numbers side, the focal point is Q4 2025 earnings in late January 2026. Market calendars currently cluster the call around January 28, 2026 after the close. That print will refresh the debate on margins, mix, and whether FSD and energy are starting to matter more than headline vehicle count. At the same time, Tesla’s robotaxi pilot in Austin is moving from novelty to routine: a small fleet of driverless Model 3/Y vehicles has been carrying paying passengers since June 2025, and the service area has already been expanded to over 200 square miles, with plans to remove “babysitter” safety monitors in key zones by year-end if performance stays clean.

This horizon is mostly about verification, not hero calls. You’re asking: “Did Q4 and the first robotaxi months look more like our Bear, Base, or Bull template?” and adjusting risk accordingly rather than trying to time every intra-day move.

Example 0–3M triggers & playbook (template, not advice):

If Q4 2025 shows volume OK but another clear step down in auto gross margin, and management leans on ‘macro/competition’ without specific fixes, treat that as a Bear-tilting print. A cautious template here is: fade post-earnings strength, cap position size, and avoid adding on first reaction rallies until you see at least one quarter of margin stabilization.

If Q4 shows stable or slightly improving auto margins, energy/storage growing fast, and FSD / software revenue called out with concrete attach and ARPU numbers, that’s Base-supportive. A common template is: buy or add on post-print dips into pre-earnings valuation bands, on the view that Tesla is tracking toward the Mixed Platform world, not a de-rated auto story.

If Tesla reports clean robotaxi safety stats in Austin, expands service further, and gets explicit signals from regulators that unsupervised operation in certain zones is acceptable, that marginally boosts Bull probability. One way to express that is keep a small, dedicated “Bull sleeve” (equity or call spreads) funded by trimming into euphoric spikes rather than by leveraging the core book.

If robotaxi headlines are dominated by accidents, regulatory pushback, or abrupt pauses in expansion, that’s a clear Bear tilt for the autonomy narrative. A disciplined template is: treat any “AI hype” bounce as an opportunity to lighten exposure and re-anchor valuation on auto + energy only until the news flow turns.

4.2 3–12 Months – 2026 Launch Year: Cybercab, Optimus, and Scaling Proof

From late February 2026 into year-end 2026, Tesla enters what management itself has framed as a “most demanding year” for the AI and robotics organization. This is when promised launches either become operating reality or slide to the right.

The centerpiece is the Cybercab. Musk has said production of this dedicated robotaxi – designed with no pedals and no steering wheel – will begin in April 2026 at Giga Texas, with ultimately electronics-like assembly rates and multi-million-unit annual potential, even as the chairwoman has floated the possibility of adding controls if regulators require it. In the same window, Tesla plans a V3 Optimus prototype in early 2026 and a three-phase blueprint to ramp production toward a line capable of up to one million humanoid robots per year later in the decade. By late 2026, investors should see whether Cybercab is genuinely in production and on public roads, and whether Optimus is doing real work inside Tesla factories or still mostly starring in demos.

Overlaying that is the 2026 earnings cycle – three quarters where we can watch how auto margins behave under launch stress, how energy/storage scales, and whether software and early autonomy revenue become visible line items. For many investors this is the sweet spot for swing trades around a core view: the fundamentals are moving fast enough to justify repricing, but not so binary that everything hinges on a single date.

Example 3–12M triggers & playbook:

If Cybercab production actually starts around April 2026, we see real vehicles in limited commercial service, and the main headlines are about ramp logistics rather than regulatory panic, that’s a clear tilt toward the Bull template (or at least away from Bear). A pragmatic playbook is: maintain or modestly increase a core long bias on pullbacks, and fund selective upside structures (e.g., call spreads) around key milestones like the first full-quarter Cybercab update.

If Cybercab slips materially beyond 2H26, or launches only with conventional controls and heavy supervision, and management walks back the “clean robotaxi” vision, that’s Base-ish at best, Bear-ish at worst. A defensive template: treat any “launch hype” spike as an opportunity to reduce exposure toward what you would hold if Tesla stays mostly an EV + energy + FSD story, not a full robotaxi platform.

If by late 2026 Tesla can credibly show Optimus deployed in its own factories with quantified productivity gains (e.g., headcount saved or throughput lifted), even if external sales are tiny, that adds real weight to the Bull robotics narrative. A constructive approach: extend your horizon on a portion of the position (e.g., roll nearer-dated calls into longer tenors; be slower to take profit on dips) while still respecting valuation bands on the auto/energy base.

If Optimus remains largely a demo product with no disclosed unit economics or factory impact, and the AI team telegraphs that 2026 is “hard” mainly because of delays or redesigns, that’s a clear sign to keep robotics in the “optionality bucket.” A sober template: do not pay extra multiple for Optimus; run sizing as if robotics is worth ≈0 in your Base case and only matters in a capped Bull-sleeve expression.

4.3 12–24 Months – AI5, Network Scale, and the Platform Verdict (late 2026 → late 2027)

By late 2026 and through 2027, we enter the verdict phase for Tesla as an AI and robotics platform. Three vectors converge: in-house AI silicon (AI5), scaled robotaxi networks, and maturing Optimus deployments.

On silicon, Musk has now acknowledged that mass production of the AI5 chip has slipped to 2027, after originally targeting 2026, with fabrication split between Samsung and TSMC under a structure that includes a multi-year, roughly $16.5B deal with Samsung. Public commentary claims AI5 will be around 40–50× “better” than AI4 by some metrics, with AI6 to follow later for even heavier robotics workloads. By mid-to-late 2027, investors should have evidence on whether AI5 is actually shipping at volume into vehicles, data centers, and robots – and whether its supposed performance-per-watt and performance-per-dollar edge shows up in either capabilities or margins.

At the same time, the service side of autonomy will be much harder to dismiss as “pilot.” Musk has talked about robotaxi access for a large share of the U.S. population and expansion into 8–10 states by the end of 2025, which implies that by 2027 Tesla should either be operating multi-city networks with meaningful ride volumes, or still battling for limited zones and reluctant regulators. Optimus, too, is supposed to be on a path toward hundreds of thousands to a million units per year by 2030; by 2027 we’ll know whether Tesla is on that ramp or not.

At this horizon the question gets binary: Does Tesla look more like our Bull “AI & robotics platform” world, or more like a strong but finite EV + energy + FSD business with some expensive side bets?

Example 12–24M triggers & playbook:

If by late 2027 AI5 is in broad deployment (vehicles, robots, data centers), management shares at least directional benchmarks that back the “performance per watt / per dollar” story, and you can see capex intensity starting to normalize rather than explode into open-ended fab spending, that’s very Bull-supportive. A long-horizon template is: justify a structural core position sized for platform-style upside, complemented by longer-dated upside expressions, while accepting higher interim volatility and tightening risk limits around idiosyncratic events (e.g., regulatory blows).

If AI5 volume production slips again, yields or costs disappoint, or Tesla moves aggressively into building its own giant fabs without clear partners or funding, turning AI silicon into a major balance-sheet risk rather than a differentiator, that is a strong Bear tilt on the platform thesis. A defensive template: reduce structural exposure toward what you’d hold if Tesla is “only” a good EV + energy + FSD business, and consider explicit downside protection (e.g., put spreads, collars) around major silicon or capex updates.

If by 2027 robotaxi networks are active in multiple cities and states with improving unit economics and regulators explicitly allowing unsupervised operation in defined zones, and Optimus is deployed at scale inside Tesla with early external customers paying real money, the Bull case is essentially “live.” A growth-oriented template is: treat deep pullbacks driven by macro or temporary mishaps as opportunities to add, but impose hard valuation and position-size caps so you don’t assume a frictionless path to platform multiples.

If robotaxis remain small, heavily constrained pilots, Optimus volumes are negligible, and most of Tesla’s reported earnings still come from selling cars and energy, despite big AI and robotics headlines, then the platform verdict is basically “no.” A disciplined template: anchor your valuation entirely on EV + energy + FSD economics, treat all AI/robotics as out-of-the-money optionality, and size positions accordingly – even if the story is still compelling narratively.

4.4 Working Rule – Align Horizon, Scenario, and Size

Across all three horizons, the discipline is the same: every dated event – Q4 earnings, a Cybercab production update, an Optimus factory deployment, an AI5 roadmap slide – is a chance to ask two questions:

Which world did this move us closer to – Bear, Base, or Bull?

Given my horizon, am I sized and hedged as if I actually believe that?

The point of this strategy menu is not to dictate trades, but to keep horizon, scenario, and position size coherent. In the rest of this PickAlpha Forward Valuation series, we’ll reuse this same map whenever Tesla clears a major milestone – and make explicit when a new headline genuinely shifts the forward valuation path, versus when it is just noise.

Section 5.

Final Note

If you’ve read this far, you’ve already done more work than most of the market ever will on a single name. That’s the point: stocks like TSLA don’t reward lazy, one-sentence narratives – they reward people who keep a live map and update it when the world moves.

Use this framework however it fits your process. Steal the scenario labels, disagree with the probabilities, swap in your own numbers – just be explicit about which world you’re underwriting and over what horizon.

And a small nod to Elon: most CEOs give us guidance; he gives us a moving target that forces us to think in paths, not slogans. Whatever you think of him, that’s exactly the kind of name worth having a forward valuation for.