PickAlpha Weekend - Look Into Next Week! | 2025-11-22

What actually priced this week, and what likely prices next. Sections: 1) Weekly Recap • 2) Look Into Next Week

Weekly Recap

At a glance — Key events:

• S&P 500 -1.9% and Nasdaq -2.7% as NVDA volatility and AI de-rating hit tech; DXY +0.9% — $SPY $QQQ

• 2Y -10 bps to 3.52%, 10Y -8 bps to 4.06% as Fed cut odds near 90–95% — $TLT $ZN=F

• WTI -3.6% to $57.81 and Brent -2.8% as demand worries outweigh supply risks — $CL=F $XLE

Equities sold off with a clear growth tilt: the S&P 500 fell 1.9%, the Nasdaq 2.7%, while Russell 2000 slipped 0.8%. Expensive AI and semiconductor names saw pressure despite NVIDIA printing $57.0B Q3 revenue and guiding Q4 near $65.0B, as investors questioned sustainability and multiples. Alphabet’s >5% weekly gain and INTU’s $3.34 EPS beat helped Communication Services and some software cushion the decline. High-yield OAS widened about 10 bps to 3.17%, consistent with risk-off and a modest de-risking in credit.

Rates and macro signaled slowing but not collapse. The 2Y yield fell 10 bps and the 10Y 8 bps, while the 10Y real yield was roughly flat at 1.86%, implying easing expectations driven more by Fed communication than inflation. Fed officials, including Waller and Williams, pointed to a possible 25 bps December cut, with futures showing roughly 90–95% odds. Yet data were noisy: the delayed September payroll report showed 119k jobs and 4.4% unemployment, the October jobs report was canceled, and November flash PMIs saw manufacturing slip to 51.9 while services held up. This combination reinforced “rates down, USD up, growth under pressure.”

Look Into Next Week

Macro Look

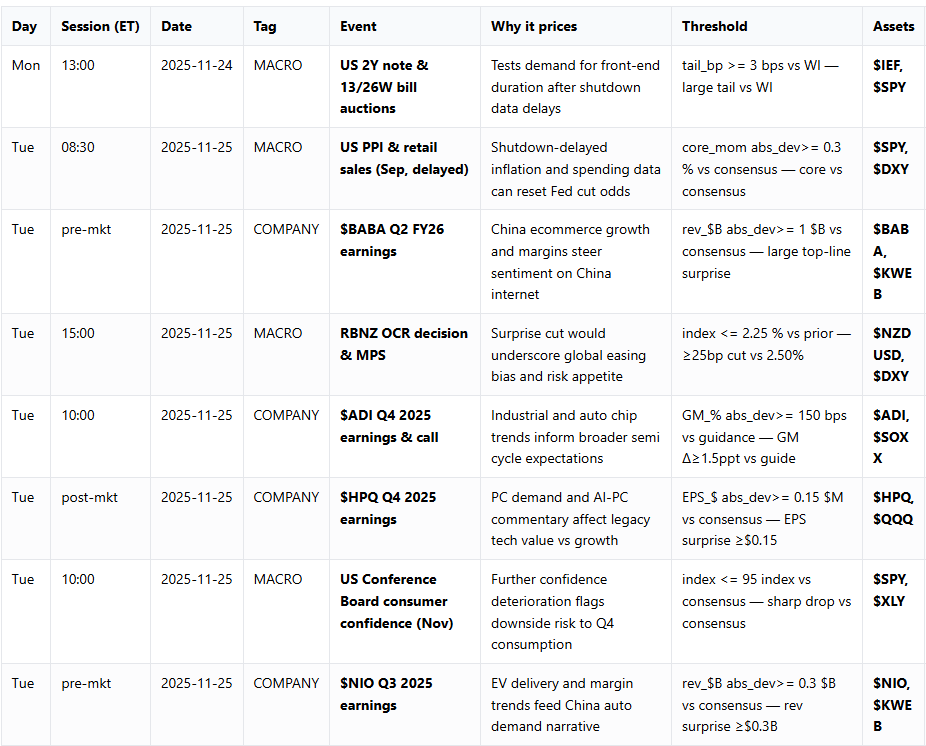

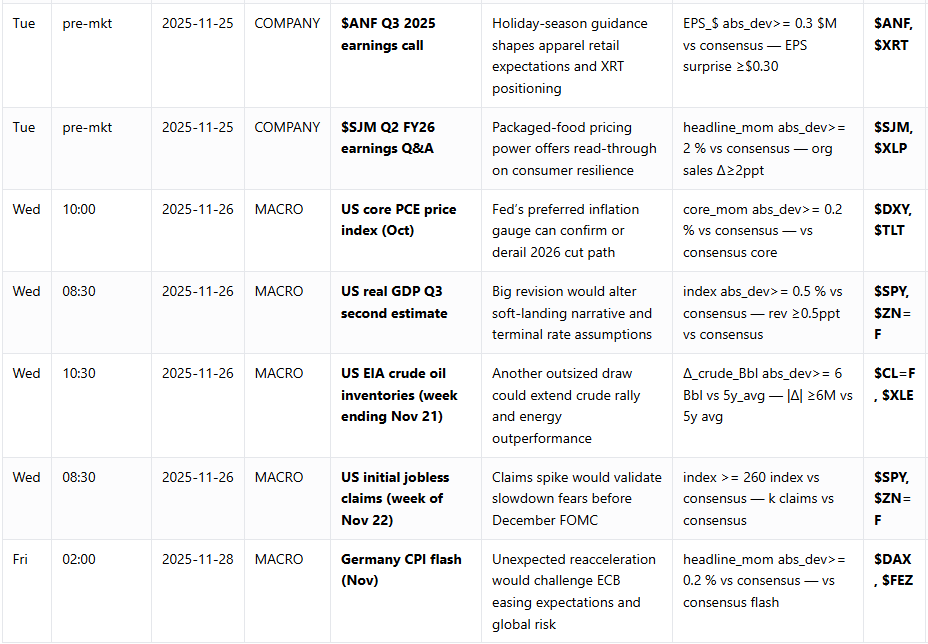

Next week’s macro calendar is dense despite the holiday-shortened window. The key focus is Wednesday’s US core PCE (materiality 92), where an absolute surprise of ≥0.2 ppt versus consensus on the m/m print would directly reset the Fed path and long-end yields via the inflation_trend→Fed_path→UST_curve channel, impacting $TLT and $DXY. Ahead of that, Tuesday’s delayed PPI/retail sales (materiality 90; |core PPI surprise| ≥0.3%) will help fill the shutdown data gap and could shift cut probabilities if spending is weak. The second estimate of Q3 real GDP (materiality 85; revision ≥0.5 ppt) rounds out the growth narrative, while front-end auctions and claims mainly test demand and slowdown fears rather than independently driving trend.

Company Look

Company catalysts are concentrated on Tuesday and skewed to China internet, EVs, and semis. Pre-market, $NIO and $BABA earnings (materiality 74 and 82) will steer sentiment in $KWEB: top-line surprises of ≥$0.3B for NIO and ≥$1.0B for BABA, plus margin commentary, inform China consumption and growth-premium narratives. For US sectors, $ANF and $SJM guidance will color discretionary versus staples resilience, particularly via holiday comp-sales percentages and organic sales growth relative to consensus by ≥2 ppt. In semis, $ADI (GM surprise ≥150 bps vs guidance) will provide a read on industrial/auto chip demand and $SOXX positioning, while $HPQ post-market shapes value-vs-growth dispersion through EPS and PC-unit trends.

The ADI print is gona be interesting with automotive chip demand still wobbly. If gross margin beats by 150bps like you said, that could finaly shift SOXX positioning after the NVDA multiple concerns. Core PCE on Wednesday matters more tho becuase if it surprises hot, the whole December Fed cut trade unwinds fast.