PickAlpha Weekend - Look Into Next Week! | 2026-02-07

1) Weekly Recap • 2) Look Into Next Week | Watchlist: $SPY $TLT $DXY $IEF $XLY $XLE $SOXX $CL=F $NG=F $KO $XLP $F $SHOP $CSCO $XLK $COIN $ABNB $AMAT •

Weekly Recap

At a glance — Key events

• Treasury lifted Q1 borrowing needs to $574B; term-premium worries, but 10Y -4 bps supported $TLT, $SPY.

• Mega-cap AI capex surged, with AMZN flagging ~$200B 2026 spend; $SOXX outperformed while Nasdaq fell 1.8%.

• WTI slid 3.3% to $63.31 despite a 3.5M bbl inventory draw; pressure persisted on $CL=F, $XLE.

U.S. equities were broadly flat-to-softer despite resilient growth signals. The S&P 500 slipped 0.1% while the Nasdaq dropped 1.8%, but small caps gained 2.2%, helped by a stronger domestic growth pulse. ISM Manufacturing printed 50.5 versus 49.7 consensus and ISM Services 53.2 versus 50.4, reinforcing a soft-landing narrative. At the same time, AI-linked capex from Amazon (~$200B for 2026) and Alphabet ($85–$90B) kept semiconductor beta firm, with $SOXX and names like NVDA up even as broader tech lagged.

Rates finished modestly lower, with the 10Y down 4 bps to 4.206% and the 2Y down 5 bps to 3.47%, leaving the 2s10s curve near +74 bps. Treasury raised its Q1 borrowing estimate to $574B and telegraphed $125B in upcoming coupon supply, but auctions and bill demand (e.g., a $77B 182-day bill at 3.525%) pointed to contained term-premium stress. DXY still gained 0.7% to 97.63, while crude fell 3.3% even with a 3.5M bbl inventory draw, softening inflation-beta and weighing on energy equities.

Look Into Next Week

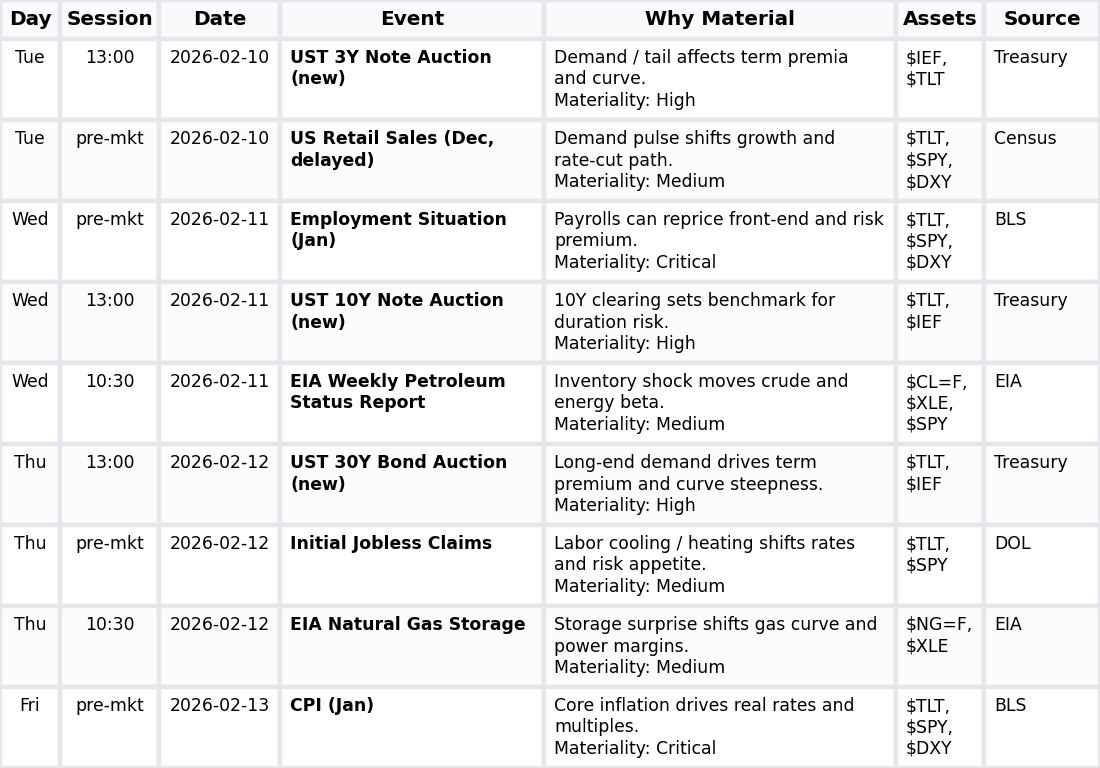

Macro Look

Next week clusters around three U.S. macro axes: inflation (CPI), labor (jobs report, claims), and supply (Treasury auctions), with energy inventories adding another layer. Together, they mainly risk repricing rates, USD, and the broader risk complex via growth, inflation, and term-premium channels.

• UST supply / auctions (3Y, 10Y, 30Y) dominate term-premium risk; numeric anchor: N/A. Driver→channel→assets: auction tails→curve levels→$TLT, $IEF, $DXY.

• Inflation data, centered on Jan CPI, steer real rates and equity duration; numeric anchor: N/A. Driver→channel→assets: core CPI→Fed path→$TLT, $SPY, $DXY.

• Labor prints (Employment Situation, initial claims) refine growth and cuts timing; numeric anchor: N/A. Driver→channel→assets: payrolls/claims→front-end rates→$TLT, $SPY, $DXY.

• Retail sales and weekly EIA oil/gas data update demand and energy balances; numeric anchor: N/A. Driver→channel→assets: demand/inventories→commodities→$CL=F, $XLE, $SPY.

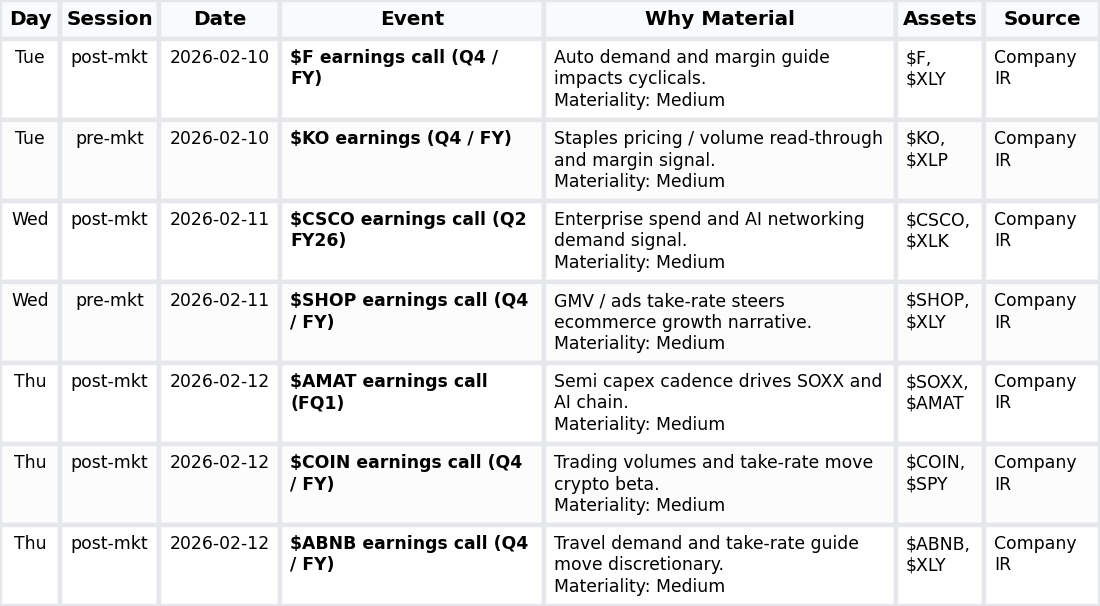

Company Look

Next week looks more sector-dispersion than pure index-beta, with a cross-section of staples, autos, ecommerce, networking, travel, crypto, and semis. The focus is how late-cycle consumer strength, AI capex chains, and risk appetite in crypto/travel reshape sector leadership inside the index.

• Consumer staples earnings (e.g., $KO) frame pricing power and volume resilience; numeric anchor: N/A. Fundamental driver→expectations→sector/index: margins→defensive bid→$XLP, $KO, $SPY.

• Cyclical consumer earnings ($F, $SHOP, $ABNB) test autos and ecommerce/travel demand; numeric anchor: N/A. Fundamental driver→expectations→sector/index: bookings/GMV/outlook→cyclical beta→$XLY, $F, $SHOP, $ABNB, $SPY.

• Tech/AI stack and networking earnings ($CSCO, $AMAT) gauge enterprise and semi-capex cadence; numeric anchor: N/A. Fundamental driver→expectations→sector/index: EPS/guide→growth leadership→$XLK, $SOXX, $AMAT, $CSCO, $SPY.

• Crypto-exposed earnings ($COIN) link trading volumes to risk sentiment; numeric anchor: N/A. Fundamental driver→expectations→sector/index: transaction revenue→risk appetite→$COIN, $BTC, $SPY.