PickAlpha Weekend - Look Into Next Week! | 2025-11-09

What actually priced this week, and what likely prices next.

Weekly Recap

At a glance — Key events:

• Treasury refunding sized 3Y $58B / 10Y $42B / 30Y $25B — $TLT/$IEF/$SPY

• ISM Services 52.4; ADP +42,000 private jobs — $SPY/$DXY

• EIA gas +33 Bcf (3,915 Bcf total); WTI −2.0% w/w — $NG=F/$CL=F

U.S. risk assets slipped (S&P −1.6%, NDX −3.1%) as AI-capex headlines concentrated returns: AMZN’s ~$38B OpenAI/AWS pact lifted AMZN (+4.4% Mon) but semis underperformed (NVDA −4.3% Fri). Rates were directionless: 10Y ~0 bps on the week while issuance and refunding composition (3Y $58B / 10Y $42B / 30Y $25B) emerged as a primary supply signal likely to affect term premia and long-end yields into November auctions.

Policy and supply signals drove commodity and bank narratives: EIA inventory flows (gas +33 Bcf; crude/product builds/draws mixed) pressured prompt NatGas but tightened distillate/gasoline cracks, while the Fed’s LFI rule easing nudged bank capital-return optionality higher. Cross-asset channels were clear: fiscal/auction sizing → term premia → TLT/10Y; services/inflation prints → front-end Fed expectations → DXY/Treasuries; inventory/outage news → energy time spreads and refiners.

Look Into Next Week

Macro Look

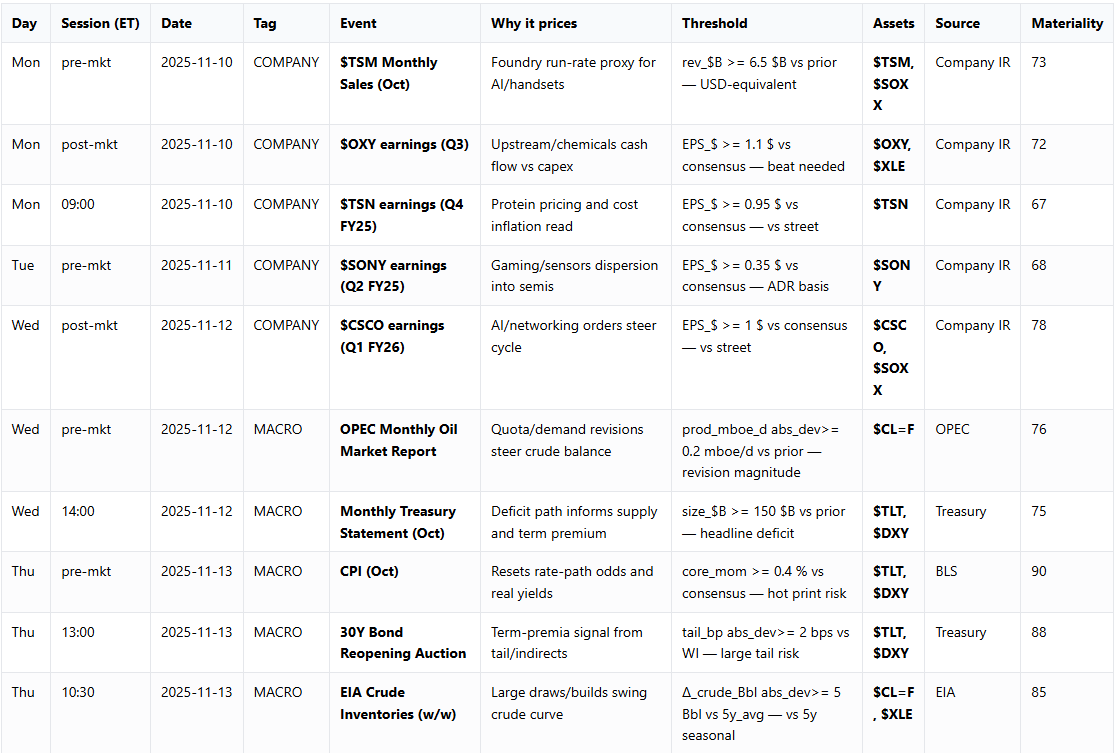

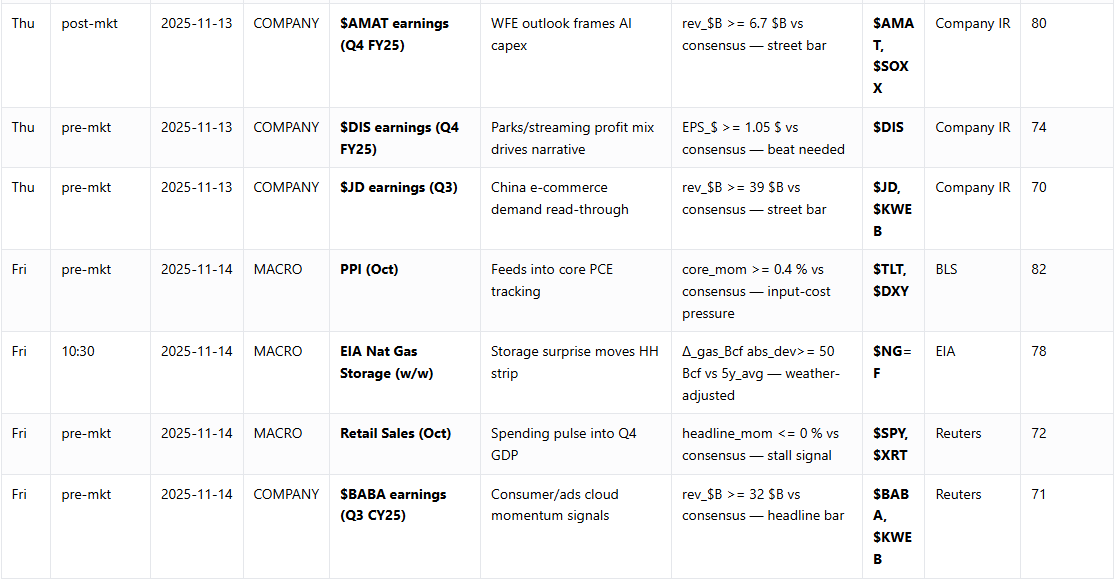

Next week’s primary rate/FX drivers are CPI (Thu pre-mkt, materiality 90; core_mom threshold 0.4%) and the 30Y reopening auction (Thu 13:00, materiality 88; tail_bp threshold 2 bps). A core CPI print ≥0.4% would lift real-yield repricing and dollar strength, pressuring long-duration equities and boosting TLT volatility; a sizable tail at the 30Y auction (>2 bps) would raise term premia and steepen local curves, again weighing on duration. Secondary drivers: EIA crude (Thu 10:30; 5.0 Bbl abs_dev) and PPI (Fri pre-mkt; core_mom 0.4%) will steer energy breakevens and input-cost expectations.

Company Look

Earnings/flows that can move sector leadership include AMAT (Thu post-mkt; rev threshold $6.7B) and CSCO (Wed post-mkt; EPS $1.00). AMAT’s revenue/GM outlook will frame WFE-driven AI capex for $SOXX; a miss below $6.7B risks downgrading semis. CSCO EPS and order commentary will signal networking demand for AI deployments. Pre-mkt reports (DIS, JD, BABA) create gap risk for $SPY/$KWEB; TSM’s Mon monthly sales ($6.5B threshold) act as a foundry run-rate proxy for core semis exposure.