PickAlpha Weekend - Look Into Next Week! | 2026-01-10

Sections: 1) Weekly Recap • 2) Look Into Next Week | Watchlist: $SPY $XLF $TLT $DXY $CL=F $XLE $IEF $NG=F $SOXX $NVDA $TSM $GC=F $JPM $C $BAC $WFC $BK $GS

Weekly Recap

At a glance — Key events:

• Payrolls +50k and unemployment 4.4% nudged Fed-cut odds back, with 10Y ~4.58% and DXY +0.7% — $SPY, $TLT

• EIA crude -3.8M bbl to 419.1M bbl lifted WTI +3.1% and supported energy beta — $CL=F, $XLE

• China H200 chip pull-forward ~1.2M units (~$27k each) drove SOXX +4.6% outperformance — $SOXX, $NVDA

Macro this week sat between still‑firm activity and slightly cooler labor signals. Nonfarm payrolls rose 50k with unemployment at 4.4%, pushing futures-implied first Fed cut toward June and leaving the 10Y around 4.58% (Thu). JOLTS job openings fell to 7.1mn, briefly favoring duration and equities before the jobs report reversed some easing hopes, with DXY +0.7% w/w to 99.13 and EURUSD down 0.7% to 1.1638 as the higher‑for‑longer narrative re‑emerged.

Rates and commodities transmitted most of the macro signal into risk assets. Front-end yields slipped 2bp w/w to 3.74% while the 10Y rose 1bp to 4.58%, steepening 2s10s by 3bp amid a strong $78.863B 42‑day bill auction at 3.560% and 2.89x bid‑to‑cover. EIA reported crude inventories down 3.8M bbl to 419.1M bbl, helping WTI gain 3.1% and Brent 4.3%. Equities were mixed: S&P 500 slipped 0.3%, Nasdaq gained 0.3%, while SOXX rallied 4.6% on China’s ~1.2M H200/H20 chip pull‑forward.

Look Into Next Week

Macro Look

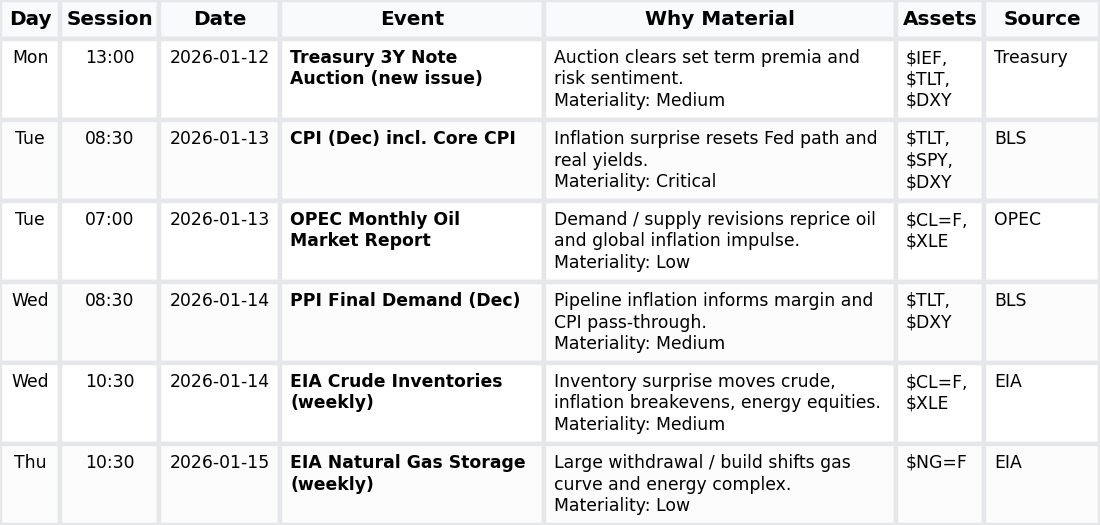

Inflation and oil will dominate next week’s macro narrative, with CPI and PPI resetting Fed-path probabilities while OPEC/EIA data steer energy and breakevens. Treasury supply through the 3Y auction adds a term‑premium test for USD and long-duration risk.

• US CPI (materiality 92) anchors the inflation bucket; core CPI m/m drives inflation→rates→USD→equities — $TLT, $SPY, $DXY

• EIA crude and gas (scores 72+58=130) shape balances→oil→inflation/risk, informing $CL=F and $XLE sensitivity — $CL=F, $XLE, $SPY

• Treasury auctions (3Y score 78) test supply→term premia→rates/FX/risk; tail/bid‑to‑cover steer $IEF and $TLT — $IEF, $TLT, $DXY

• PPI (score 76) feeds input prices→inflation→rates, refining margin and CPI pass‑through expectations — $TLT, $DXY

• OPEC report (score 69) updates oil balance→crude→inflation/risk via production/demand revisions — $CL=F, $XLE

Company Look

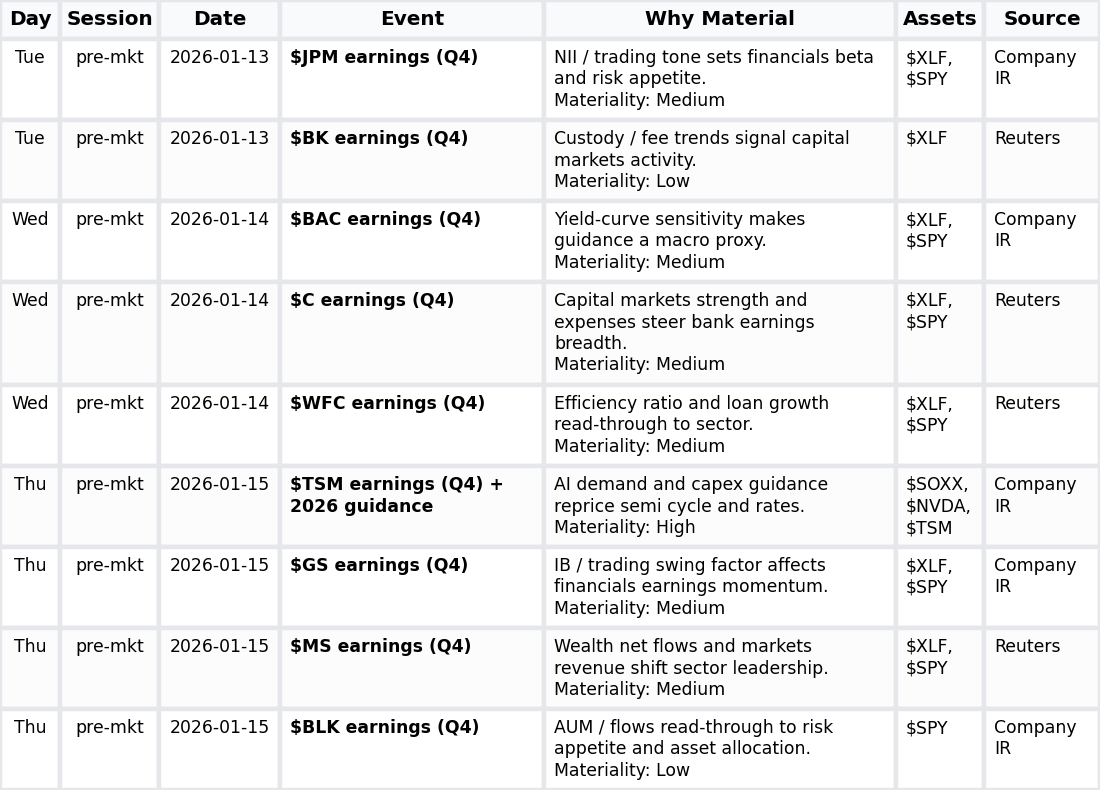

Next week skews toward index‑beta rather than idiosyncratic dispersion, with U.S. financials’ Q4 prints driving $XLF and a single large-cap semi guidance event ($TSM) potentially swinging $SOXX and growth leadership.

• Large-bank earnings (JPM, C, BAC, WFC; scores 80+72+73+70) drive earnings→expectations→financials/index via NII, credit, and costs; numeric anchor: EPS guide N/A — $XLF, $SPY, $TLT

• Market‑linked/fee earnings (BK, GS, MS, BLK; scores 64+71+70+66) affect fees→risk appetite→index through trading, IB, and AUM trends; numeric anchor: AUM/flows N/A — $XLF, $SPY

• $TSM 2026 guidance (score 88) steers AI capex→semis→index/rates via GM/capex/revenue outlook; numeric anchor: capex/GM N/A — $TSM, $SOXX, $NVDA