PickAlpha Weekend - Look Into Next Week! | 2026-01-10

1) Weekly Recap • 2) Look Into Next Week | Watchlist: $SPY $XLF $TLT $DXY $CL=F $XLE $IEF $NG=F $SOXX $NVDA $TSM $GC=F $JPM $C $BAC $WFC $BK $GS • What priced this week, and what prices next week.

Weekly Recap

At a glance — Key events

• Payrolls +50k and unemployment 4.4% nudged Fed cut expectations later, pressuring $TLT and capping $SPY at -0.3% w/w.

• EIA crude inventories -3.8M bbl to 419.1M bbl lifted WTI +3.1% w/w and supported $XLE.

• China H200 chip pull-forward (~1.2M units at ~$27k) drove SOXX +4.6% w/w and $NVDA strength.

Labor and inflation expectations dominated cross‑asset moves. The December payroll gain of 50,000 with 4.4% unemployment reduced odds of an April cut, pushing the implied easing start toward June and leaving the 10Y near 4.58% (Thu). DXY gained 0.7% to 99.13 as EURUSD slipped 0.7% to 1.1638. Fed commentary from Kashkari, Barkin, and Miran, combined with JOLTS openings at 7.1mn, widened uncertainty around how far beyond two 25 bp cuts the 2026 path might go, keeping duration and rate‑sensitive equities choppy.

Commodities and policy added idiosyncratic drivers. A 3.8M bbl crude draw, taking inventories to 419.1M bbl, pushed WTI up 3.1% to $59.12 and underpinned energy equities. The UN trimming 2026 global growth to 2.7% and a proposed $200bn Fannie/Freddie MBS purchase program both pointed to a below‑trend but supported backdrop for risk and housing‑linked assets. Meanwhile, BEA’s clustering of GDP/PCE into January 22 and February 20 increased future one‑day macro risk for $SPY and $TLT. Credit stayed steady with IG OAS at 79bp, while VIX ended at 14.49.

Look Into Next Week

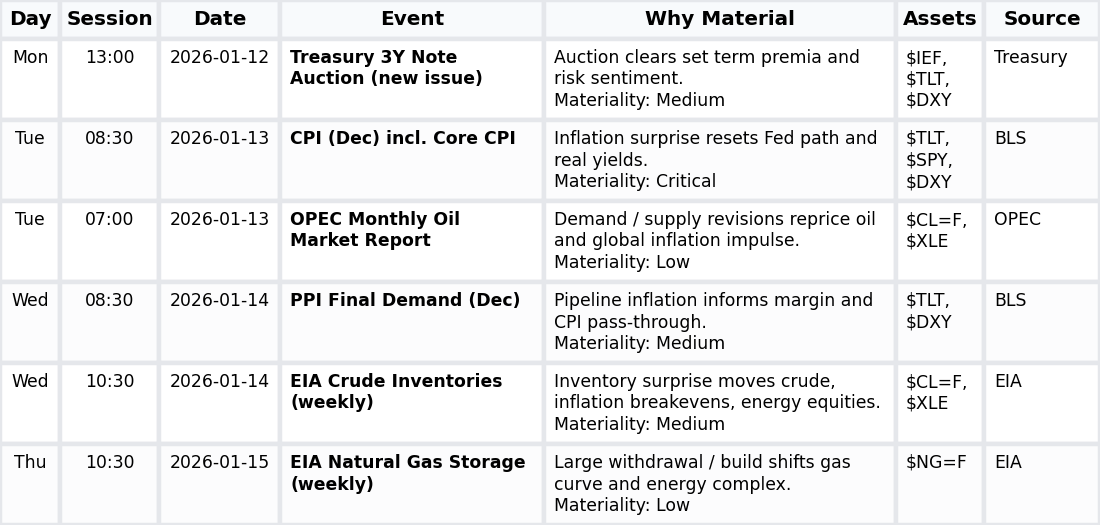

Macro Look

Next week centers on U.S. inflation and energy balances, with CPI and PPI guiding the Fed path and EIA/OPEC shaping the commodity‑linked inflation impulse. Treasury supply via the 3Y auction adds a term‑premium test for rates, USD, and risk assets.

• Energy balances (EIA crude/gas; total materiality 130) — numeric anchor: 130; inventory surprises → oil/gas curves→ inflation beta in $CL=F, $XLE, $SPY.

• CPI (Dec; materiality 92) — numeric anchor: 92; core CPI m/m → real yields → $TLT, $SPY, $DXY.

• UST supply (3Y auction; materiality 78) — numeric anchor: $78B range‑proposal; tail/BTC → term premia → $IEF, $TLT, $DXY.

• PPI (Dec; materiality 76) — numeric anchor: 76; input prices → margin/inflation expectations → $TLT, $SPY, $DXY.

• OPEC report (materiality 69) — numeric anchor: 69; production/demand revisions → crude path → $CL=F, $XLE, $DXY.

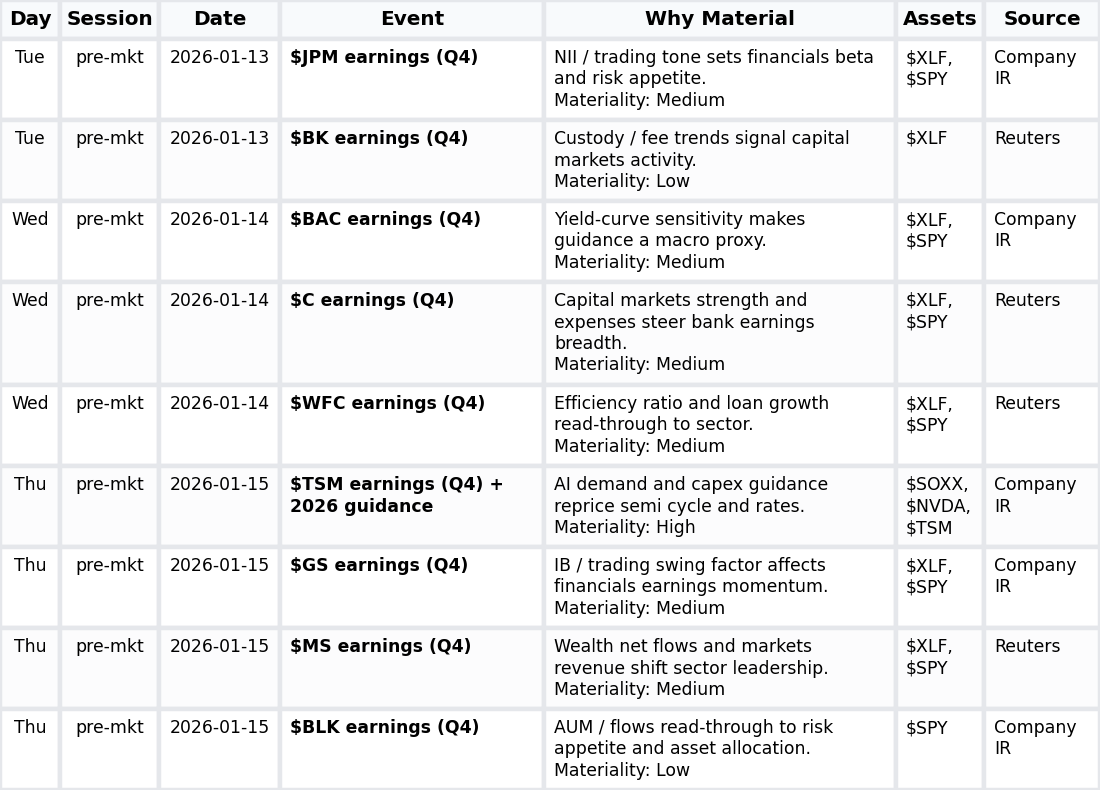

Company Look

Next week looks more sector‑dispersion than pure index‑beta, with U.S. financials’ Q4 prints and one major semi guidance update steering rotations between $XLF, $SOXX, and the broader $SPY. Bank earnings read through to the macro narrative, while TSM’s AI outlook anchors semi expectations.

• U.S. money‑center / custody bank earnings (JPM, BAC, C, WFC, BK; sum materiality ~359) — numeric anchor: N/A; loan/NII/fee trends → earnings expectations → $XLF, $SPY, $TLT.

• Wall Street and asset‑manager earnings (GS, MS, BLK; sum materiality ~207) — numeric anchor: N/A; IB/trading/flows → risk appetite and equity allocation → $XLF, $SPY.

• Global semi guidance (TSM; materiality 88) — numeric anchor: N/A; AI capex and GM outlook → semi cycle expectations → $SOXX, $NVDA, $TSM.

This note is for information only and is not investment advice or a solicitation to transact.

Really sharp breakdown of the macro setup. The way those 50k payrolls shifted Fed pricing whiel energy inventories moved in the opposite direction creates this wierd cross-asset tension that most people miss. I've been tracking credit spreads alongside VIX and that 79bp IG OAS staying flat says alot about how institutonal flows are actually positioning for Q1.