PickAlpha Weekend - Look Into Next Week! | 2025-12-06

What actually priced this week, and what likely prices next. Sections: 1) Weekly Recap • 2) Look Into Next Week

Weekly Recap

At a glance — Key events (3-5 bullets; each ≤22 words; one number + assets):

• Netflix–WBD ~$83B deal drove media dispersion; WBD >+6%, NFLX -~3%, $XLC beat $SPX — $NFLX, $WBD, $XLC

• ISM manufacturing 48.2 vs services 52.6 steepened 2s10s by ~4 bps; DXY -0.5% — $DXY, $IEF, $TLT

• Initial claims 191k vs 220k cons.; Russell 2000 +0.8% and CDX IG -2 bps — $IWM, $HYG

• WTI +3.1% to ~$60.1, inventories +0.6M bbl; energy +~1.4% — $CL_F, $XLE

Equities drifted higher, with the S&P 500 up 0.3%, Nasdaq 0.9% and Russell 2000 0.8%, as investors leaned into growth and cyclicals. Mixed ISM data (manufacturing 48.2, services 52.6) and an 89% implied probability of a 25 bp Fed cut kept the “slow goods, steady services” narrative intact. That backdrop nudged 2Y and 10Y yields up ~5 bps and ~9 bps, steepening 2s10s by ~4 bps, while investment-grade spreads tightened ~2 bps and VIX slipped to 15.4.

Macro and policy signals were nuanced. China’s private manufacturing PMI at 49.9 versus 50.5 consensus undercut EM cyclicals, while U.S. initial claims at 191k vs ~220k and delayed NFP reinforced a still-tight but debated labor picture. Oil markets balanced supply headlines—OPEC+ maintaining roughly 3.24 mb/d in cuts and a 0.6M bbl U.S. inventory build—against Kazakhstan-related disruptions, leaving WTI up 3.1% and Brent 1.1%. Regulatory actions, including FTC conditions on the Boeing–Spirit deal and DOJ-required power-plant divestitures for Constellation–Calpine, reduced some deal-risk premia without fully settling earnings trajectories.

Look Into Next Week

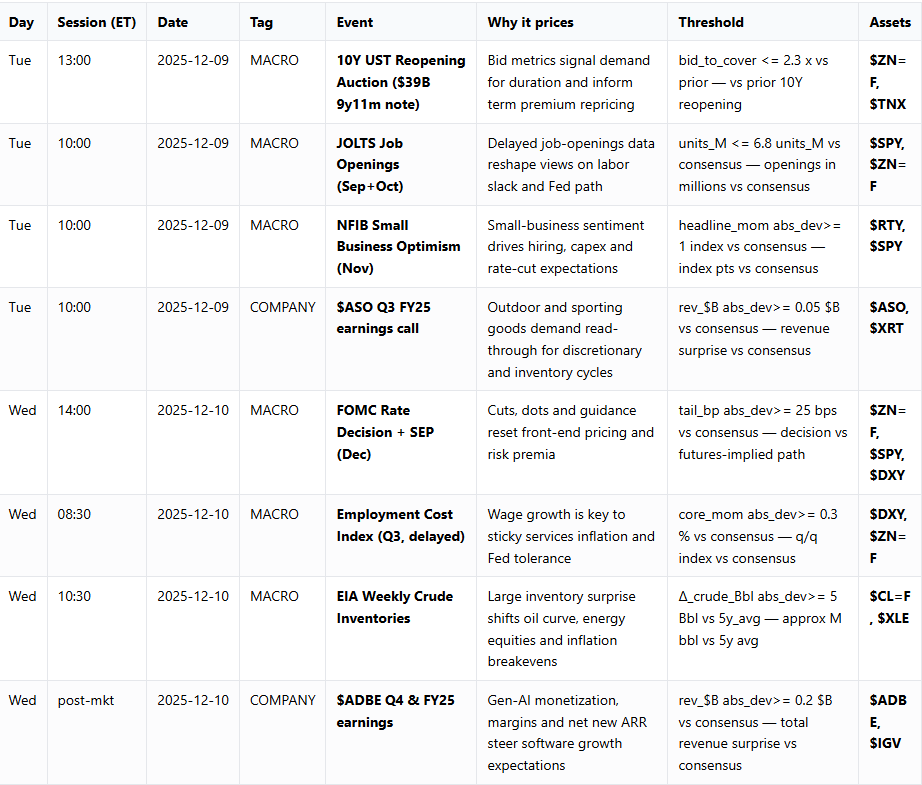

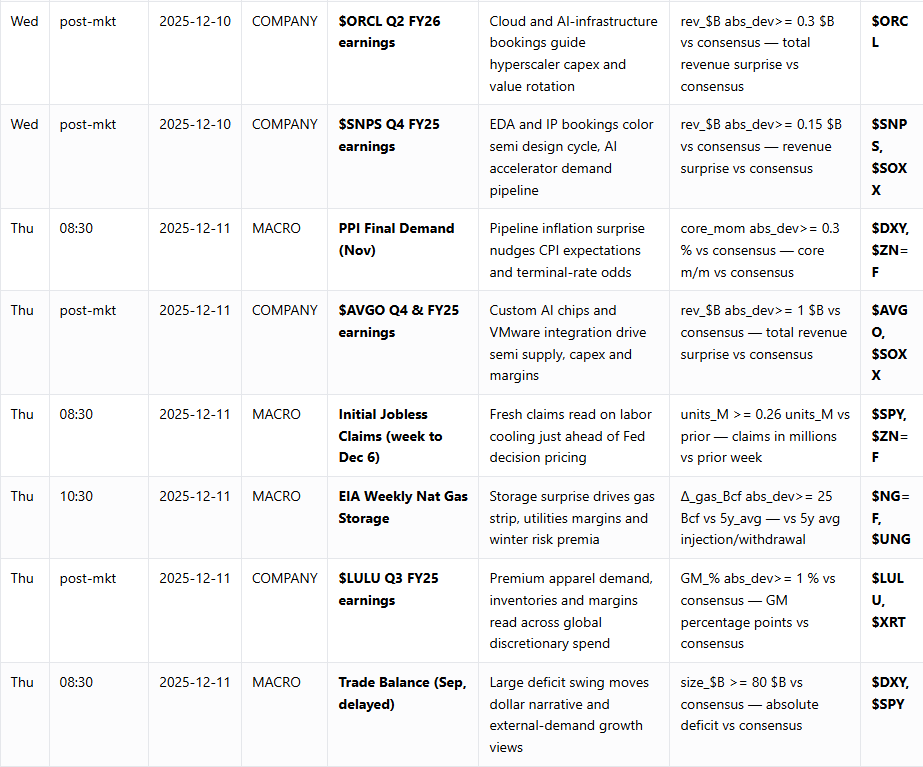

Macro Look

Next week’s macro focus is squarely on the Fed. The FOMC decision and SEP on Wednesday (materiality 99) will test current pricing of near‑term cuts; a ≥25 bp tail versus futures could reprice the curve, with $ZN=F and $DXY most exposed and knock‑on effects for $SPY. Ahead of that, the delayed Employment Cost Index (materiality 88) and Thursday’s PPI (materiality 88) will refine views on wage and pipeline inflation; ≥0.3 ppt surprises versus consensus would challenge the “gentle disinflation” view and push real yields higher. JOLTS and the 10Y auction (bid‑to‑cover ≤2.3x) round out labor and term‑premium risk for rates, USD and energy‑linked breakevens.

Company Look

Earnings skew toward software, semis and discretionary leaders. Adobe, Oracle and Synopsys (materiality 78–82) report post‑market Wednesday, with revenue surprises of ≥$0.2–0.3B and AI‑linked ARR/backlog growth likely to steer $IGV, $QQQ and $SOXX factor rotations. On Thursday, Broadcom’s print (revenue surprise threshold $1B) will be a key read on custom AI‑chip demand and VMware integration, with implications for semi supply chains and growth‑vs‑value performance. Lululemon (GM deviation ≥1 ppt) will update premium discretionary and margin resilience, while Academy Sports & Outdoors earlier in the week offers a smaller but relevant read on goods demand and inventory discipline for $XRT.