PickAlpha Weekend - Look Into Next Week! | 2025-11-15

Sections: 1) Weekly Recap • 2) Look Into Next Week • 3) Inference Review What actually priced this week, and what likely prices next.

Weekly Recap

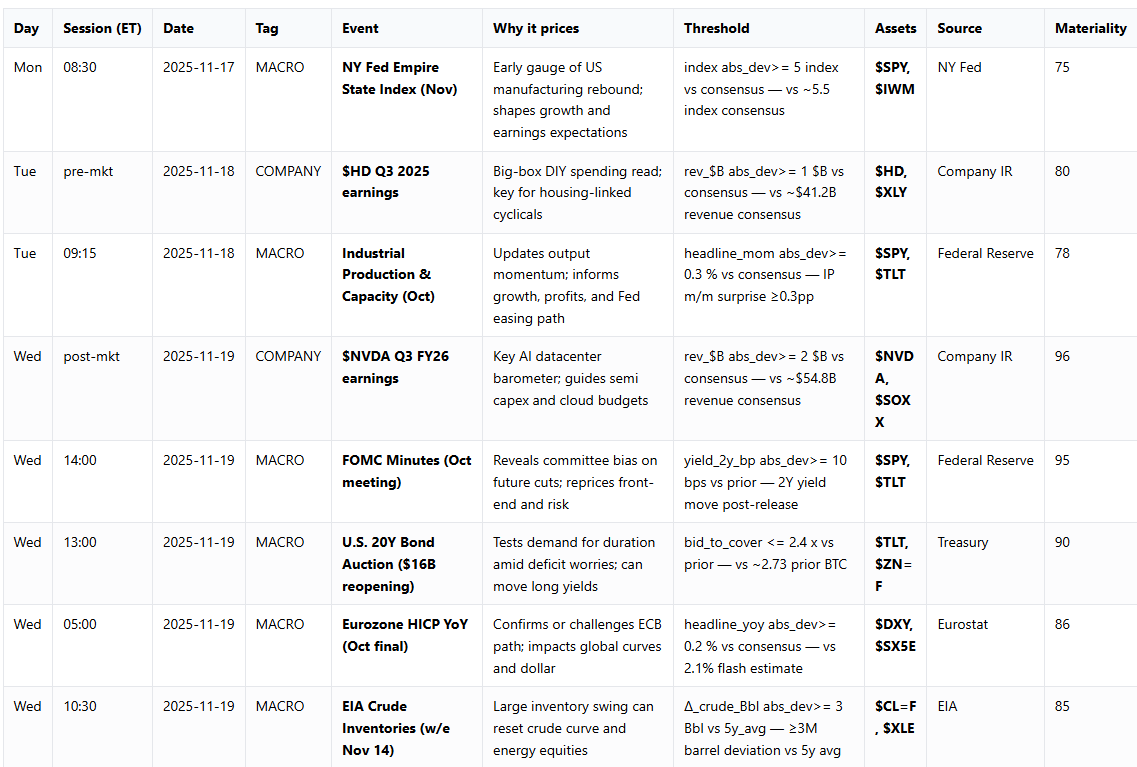

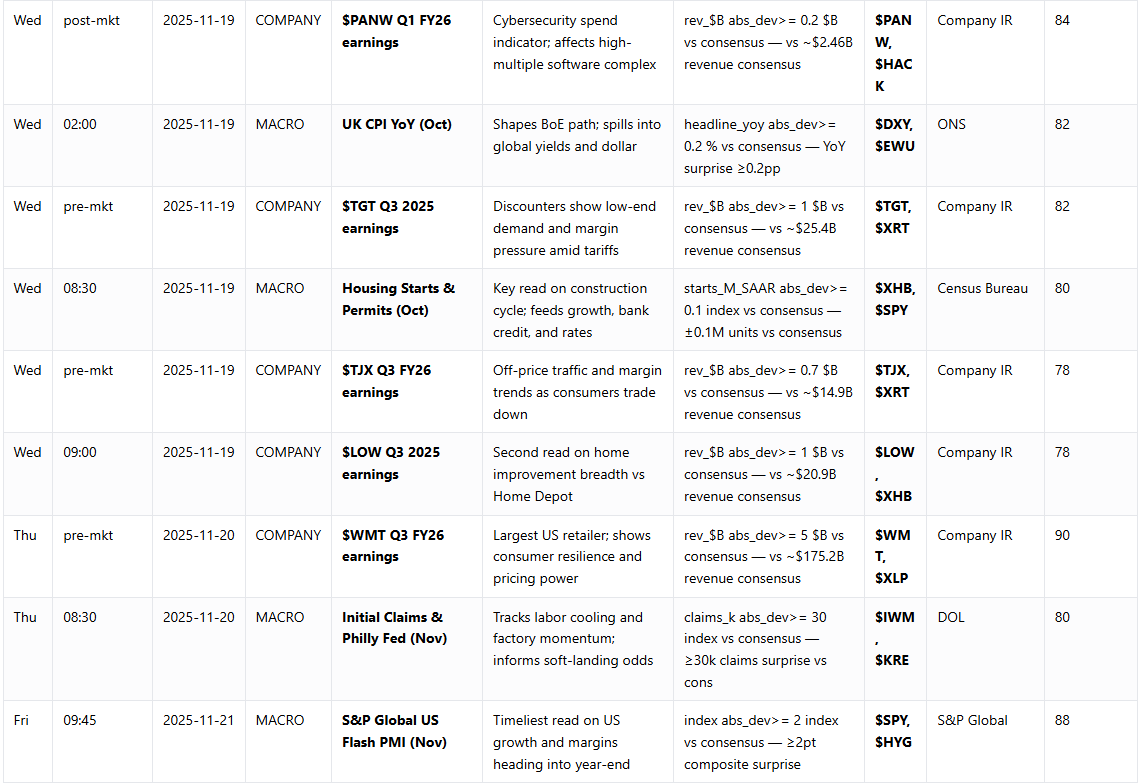

At a glance — Key events:

• Policy relief cut risk premia after a 43‑day shutdown; assets: SPY, IWM.

• Heavy Treasury refunding ≈ $125B; 10Y +6 bps — assets: ZN=F, TNX.

• Seaborne oil outages remove ~0.4 mb/d prompt supply, supporting front-month crude — assets: CL=F, XLE.

The policy pivot that ended the 43‑day shutdown and the retroactive food‑tariff rollback reduced visible tail risk, nudging DXY down ~0.3% while 10‑year yields rose ~6 bps. Markets absorbed substantial Treasury coupon supply (~$125B across 3y/10y/30y), lifting term premia and pressuring long-duration multiples even as equity indices were essentially flat (S&P +0.1% w/w). The Fed’s final IORB/primary credit rule formalized administered rates (IORB 3.90%, primary credit 4.00%), anchoring short-end mechanics.

Corporate and commodity drivers reinforced the mixed tape. Cisco’s FY26 revenue guide to up to $61B and AMD’s $100B data‑center ambition kept large-cap tech sentiment supported despite Nasdaq weakness; meanwhile energy saw supply shocks (Lukoil/West Qurna‑2 and Novorossiysk shutdowns) and an EIA natural‑gas build of +45 Bcf, keeping front-month crude and refiners sensitive to prompt differentials. Volatility and credit stayed orderly (VIX ~19.8; HY OAS ~309 bps). Informational only — not investment advice.

Look Into Next Week

Macro Look

FOMC minutes (Wed) and a U.S. 20‑year auction (Wed 13:00 ET) are the top rate‑market levers: the minutes can reprice 2‑year expectations (threshold: 2y move ≥10 bps) and drive front‑end volatility, while a weak 20Y bid‑to‑cover (≤2.4x threshold) would lift term premia and long yields, pressuring long-duration equities (SPY, QQQ) and supporting TLT/IEF moves. Eurozone HICP and UK CPI (Wed) can nudge global curves and the dollar (thresholds ±0.2%); EIA crude stocks (Wed 10:30 ET, ≥3M‑barrel surprise) remain the key trigger for CL=F and XLE moves.

Company Look

Earnings cluster centers on mega‑cap semiconductors and large retailers. NVDA’s post‑market print (Wed post‑mkt) is the highest single risk (rev threshold ±$2.0B vs ~$54.8B consensus) and can gap SOXX/SMH and market leadership; HD/TGT/WMT are pre‑market events that set retail/DIY breadth risk and can reweight XLY/XHB intraday (HD rev shock threshold $1.0B; WMT $5.0B). Retail/consumer prints carry gap risk into opens; NVDA after‑hours can reset index exposures for Thursday session.