PickAlpha Weekend - Look Into Next Week! | 2026-01-31

1) Weekly Recap • 2) Look Into Next Week | Watchlist: $TLT $SPY $DXY $SOXX $QQQ $CL=F $XLE $DIS $XLC $PEP $XLP $AMD $GOOGL $QCOM $AMZN $VGK $EWU • What priced this week, and what prices next week

Weekly Recap

At a glance — Key events

• Fed held 3.50–3.75%, front-end eased with 2Y -8bp (3.52%); DXY -1.1% — $TLT, $SPY

• December PPI +0.5% m/m vs +0.2% consensus, lifting rate-vol and pressuring duration — $ZN=F, $SPY

• WTI +6.8% (61.07 → 65.21) on -2.3M bbl crude draw vs +1.8M build expected — $CL=F, $XLE

• Q3 2025 productivity +4.9%, unit labor costs -1.9%, supporting margins and duration — $SPY, $ZN=F

• Gold above $5,000 and DXY 96.32 (-1.1% w/w) signaled mixed risk and FX positioning — $GLD, $DXY

Rates and FX traded around a tug-of-war between growth and inflation signals. The FOMC held at 3.50–3.75%, helping pull 2Y yields down 8bp even as the 10Y rose 2bp to 4.26%, steepening 2s10s by ~10bp. A stronger‑than‑expected 0.5% m/m December PPI and firm core services supported higher breakevens and front‑end yields, while revised Q3 2025 productivity at 4.9% and unit labor costs -1.9% argued for a more benign medium‑term inflation backdrop. Bowman’s indication of three 25 bp cuts in 2026 preserved an easing bias, softening the dollar (DXY -1.1%).

Macro and policy headlines outside the Fed also shaped risk. US consumer confidence dropped to 84.50, the lowest since 2014, flagging demand risk for discretionary sectors, while the Richmond Fed survey stayed in contraction at -6. Manufacturing softness contrasted with strong energy pricing: WTI gained 6.8% and Brent 7.3% as a -2.3M bbl EIA crude draw beat expectations for a +1.8M build, even as OFAC’s Venezuela General License 46 suggested future supply relief. Regulatory activity—from SEC tokenized‑securities guidance to enforcement in ad‑tech and agri‑business—added idiosyncratic governance risk, but broad equity indices still eked out modest gains, with the S&P 500 up 0.3% and the Nasdaq down 0.2%.

Look Into Next Week

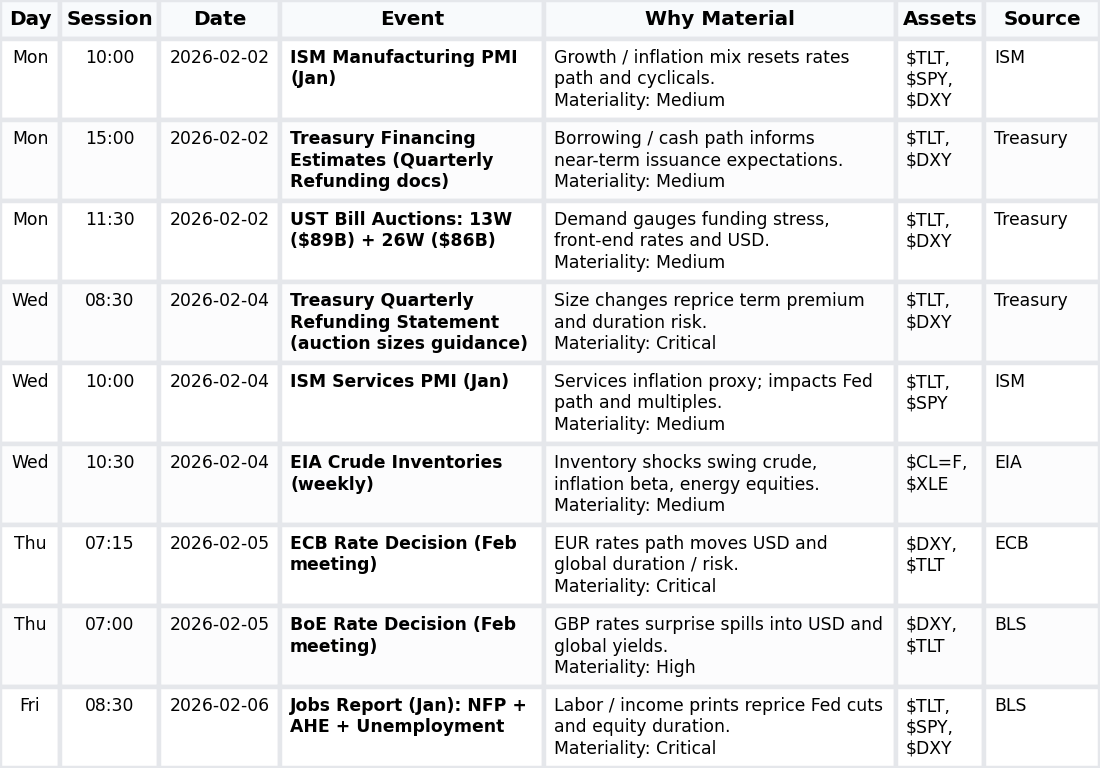

Macro Look

Next week clusters around three themes: global central-bank decisions (ECB, BoE), U.S. labor and activity data (NFP, ISM), and Treasury supply. The main transmission channels run through rates and the USD, which then feed into risk assets and energy via crude inventories and issuance-driven term premia.

• Global central banks (OTHER): ECB and BoE decisions at 07:00–07:15 ET steer cross‑currency rate differentials; driver→FX→global risk/rates — $DXY, $TLT, $VGK

• Treasury supply/term premia (SUPPLY): Quarterly Refunding guidance and borrowing estimates (sizes in $B) reprice duration; supply→term premia→rates/equities — $TLT, $DXY, $SPY

• Growth/inflation PMIs (ISM): Jan ISM manufacturing/services at 10:00 ET recalibrate growth and prices‑paid; PMIs→rates path→cyclicals/multiples — $SPY, $TLT, $DXY

• Labor market (NFP): Jan jobs report at 08:30 ET shapes cuts timing and equity duration; wages→inflation→yields→equities/USD — $TLT, $SPY, $DXY

• Oil balances (EIA): Weekly crude inventories at 10:30 ET shift inflation‑beta; stocks change (M bbl)→crude→energy/risk — $CL=F, $XLE, $SPY

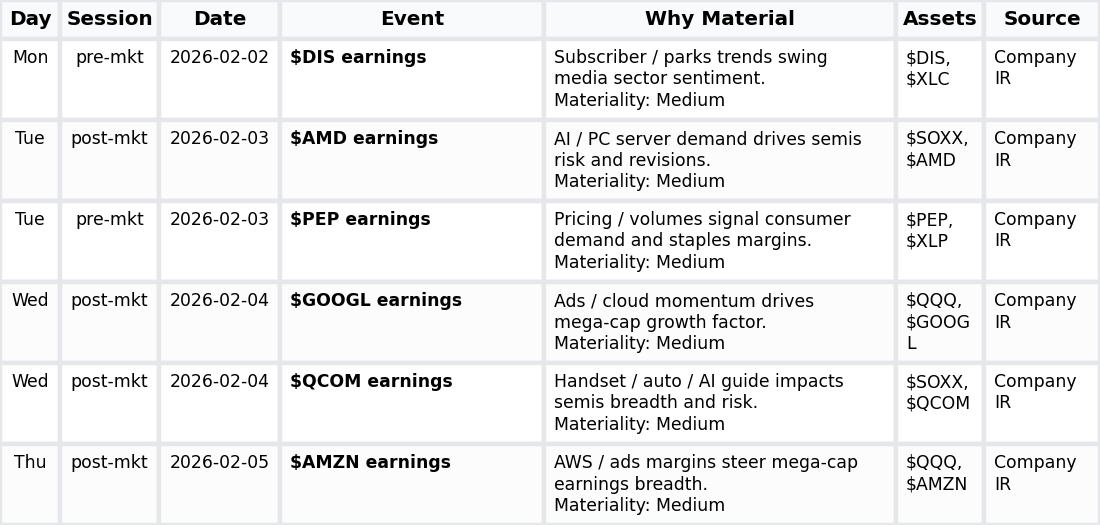

Company Look

Next week looks index‑beta heavy given mega‑cap earnings (GOOGL, AMZN, AMD, QCOM), with additional sector dispersion from media/streaming and staples (DIS, PEP). The dominant themes are AI/semis demand, cloud/ads profitability, and the resilience of consumer spending across discretionary and staples.

• Mega‑cap platforms (EARNINGS): GOOGL and AMZN results steer cloud/ads and margin narratives; numeric anchor: N/A; fundamentals→growth expectations→index/QQQ beta — $GOOGL, $AMZN, $QQQ, $SPY

• Semiconductors/AI (EARNINGS): AMD and QCOM shape datacenter, handset, and auto demand assumptions; numeric anchor: N/A; end‑demand→semis revisions→tech risk — $AMD, $QCOM, $SOXX, $SPY

• Media/consumer services (EARNINGS): DIS subscriber and parks trends inform streaming and experience spending; numeric anchor: N/A; user/traffic→sector rerating→communication services — $DIS, $XLC, $SPY

• Staples/defensives (EARNINGS): PEP pricing and volume mix gauge consumer elasticity and margin defense; numeric anchor: N/A; input costs→staples margins→defensive bid — $PEP, $XLP, SPY 0.00%↑