PickAlpha Weekend - Look Into Next Week! | 2025-12-27

What actually priced this week, and what likely prices next. Sections: 1) Weekly Recap • 2) Look Into Next Week | Watchlist: $SPY $DXY $TLT $SHY $BIL $CL=F $IEF $IWM $XLE $EEM $OWLS $TSLA $QQQ $GBX

Weekly Recap

At a glance — Key events:

• Q3 GDP at 4.3% SAAR with softer PCE (~2.2%) lifted growth beta; S&P +1.4% — $SPY

• 7Y UST auction cleared $44B at 3.93% with 2.51x BTC; 10Y -2 bps — $TLT

• Venezuela/tanker and CPC loadings cut 33% whipsawed oil; WTI +0.1% but -3.1% Fri — $CL=F

Equities ground higher into year‑end on a clean “growth without heat” mix. Q3 GDP was revised to 4.3% SAAR while PCE tracked near 2.2%, supporting the S&P 500’s 1.4% weekly gain to 6,932 and Russell 2000’s 2.1% rise. Claims around 214–215k underlined a still‑firm labor market, keeping a soft‑landing narrative intact. Tech and basic materials outperformed, helped by Alphabet’s $4.75B Intersect Power deal targeting 10.8 GW, which reinforced AI‑power and renewable build‑out themes.

Rates and commodities were quieter in level terms but important in signaling. The 2Y and 10Y each fell about 2 bps to 3.46% and 4.14%, with the 7Y’s $44B auction (2.51x bid‑to‑cover, $25.9B indirects) confirming healthy duration demand. Oil ended roughly flat on the week (WTI +0.1% to $56.74) despite a 3.1% Friday selloff as U.S. enforcement on Venezuelan flows, a 33% CPC loading cut (removing 0.57 mbpd), and an IEA‑flagged 3.84 mb/d 2026 surplus pulled the curve between near‑term tightness and medium‑term glut.

Look Into Next Week

Macro Look

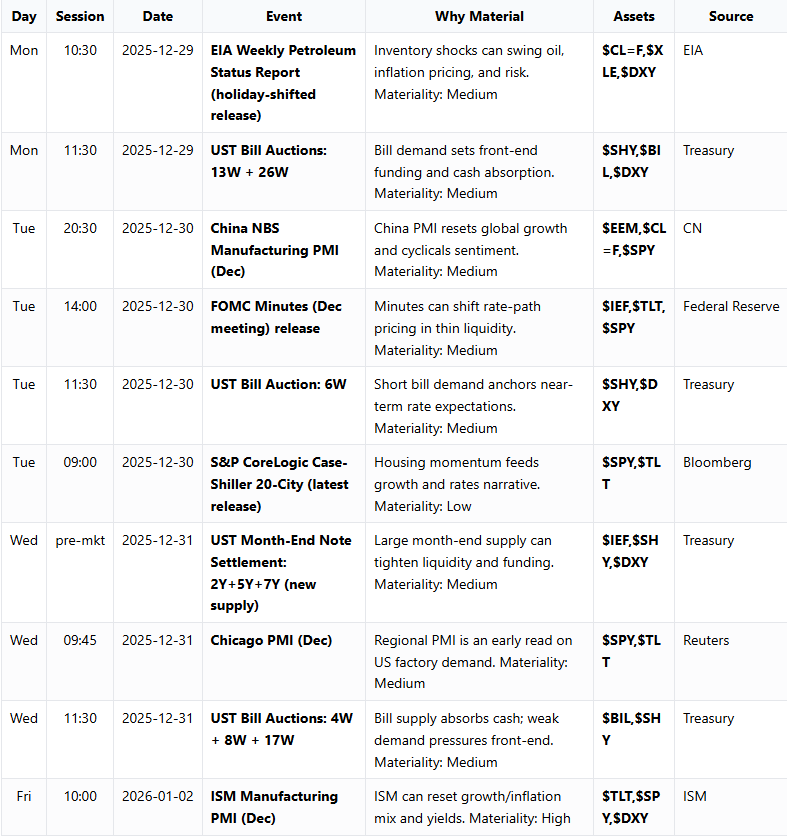

Summary: Next week is macro-heavy despite thin liquidity, with manufacturing PMIs, Fed minutes, and bill supply likely steering rates, USD, and cyclicals. Energy balances via EIA and Treasury settlements could add noise in front-end funding and oil-sensitive risk.

• Inflation/growth PMIs (ISM, Chicago, China NBS; ISM materiality 88) — activity data→rates expectations→$SPY/$TLT; numeric anchor: 49.0 index cutoff — $SPY, $TLT, $DXY

• Fed and housing color (FOMC minutes, Case‑Shiller; OTHER total materiality ~297) — policy bias→2Y/term premia→equities; numeric anchor: 0.3% m/m — $SPY, $TLT, $DXY

• Crude balances (EIA; materiality 82) — inventory surprise→oil→breakevens→rates; numeric anchor: 5M bbl vs 5‑year average — $CL=F, $XLE, $DXY

• Treasury supply and bills (AUCTIONS + SUPPLY total materiality ~288) — cash absorption→front‑end→USD/risk; numeric anchor: ≥$180B settlement or BTC ≤2.5x — $SHY, $BIL, $DXY

Company Look

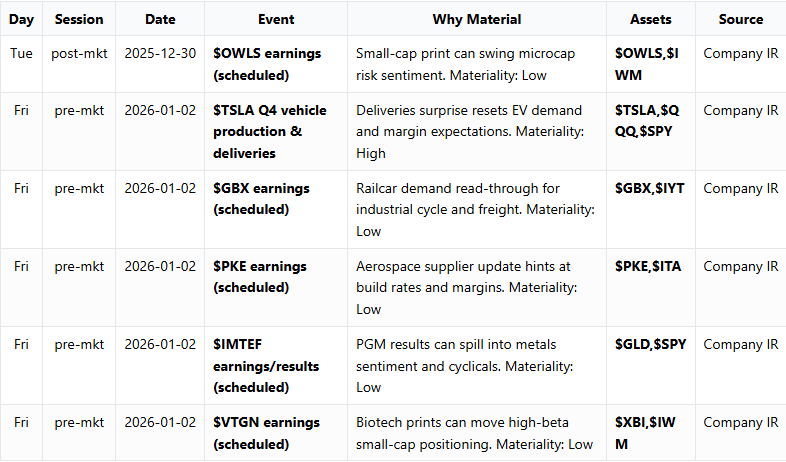

Summary: Company risk is still sector‑specific rather than index‑driven, but a few prints and TSLA’s delivery report can influence small caps, EVs, and cyclicals. Expect dispersion in microcaps, transports, and aerospace more than broad earnings beta.

• Earnings bucket (OWLS, GBX, PKE, VTGN, IMTEF; total materiality ~272) — results/guidance→sector sentiment→index tails; numeric anchor: ≥$0.15 EPS surprise for $GBX — $GBX, $IYT, $SPY, $PKE, $XBI

• Production/operations bucket (TSLA deliveries; materiality 88) — units/mix→margin expectations→mega‑cap beta; numeric anchor: ≥0.03M units vs consensus — $TSLA, $QQQ, SPY 0.00%↑