PickAlpha Weekend - Look Into Next Week! | 2025-12-20

What actually priced this week, and what likely prices next. Sections: 1) Weekly Recap • 2) Look Into Next Week | Watchlist: $SPY $TLT $IEF $DXY $XLE $CL=F $NG=F $LMNR $MFIC $ICE $NDAQ $CBOE $LQD

Weekly Recap

At a glance — Key events:

• Softer US CPI at 2.7% YoY steepened curves and supported growth equities, with 10Y -5 bps w/w — $SPY, $TLT

• Venezuela “blockade” headlines and PDVSA disruptions left Brent -1.1% w/w and WTI -1.3% — $CL=F, $XLE

• TikTok USDS $14B JV talk lifted $ORCL +6.6% Friday, boosting software beta — $ORCL, $IGV

• VIX fell 11.6% Friday to 14.91, capping a 14.9–18.0 range week — $SPY, $VIX

• China activity and home prices missed, pressuring EM FX/equities as US dollar rose 0.2% — $FXI, $DXY

Equities were broadly flat but factor-rotating. The S&P 500 gained 0.1% w/w and Nasdaq 0.5%, while Russell 2000 fell 0.9%, with Consumer Discretionary up 1.36% and Energy down 2.92%. TikTok USDS headlines implying a $14B JV and a 15% Oracle stake drove $ORCL up 6.6% on Friday, reinforcing mega-cap/software leadership as VIX dropped 11.6% to 14.91. EM risk lagged as China November industrial output rose only 4.8% YoY and retail sales 1.3% YoY, alongside a 0.4% MoM and 2.4% YoY fall in new home prices.

Macro was dominated by disinflation and benign supply. UST 2Y and 10Y yields fell 5 bps w/w to 3.49% and 4.15%, with the 2s10s spread near 67 bps as a soft US CPI print at 2.7% YoY and wage cooling in the +64k NFP report pulled forward Fed-easing expectations. A solid 5Y TIPS auction (BTC 2.62, high rate 1.433% vs 1.438% WI) contained term premium and helped VIX retest 14.9. Oil weakened, with WTI at $56.52 and Brent at $60.47, despite China’s estimated 12.1 mbpd Q4 crude imports and 1.1 mbpd stock-builds, leaving Energy down 2.9% for the week.

Look Into Next Week

Macro Look

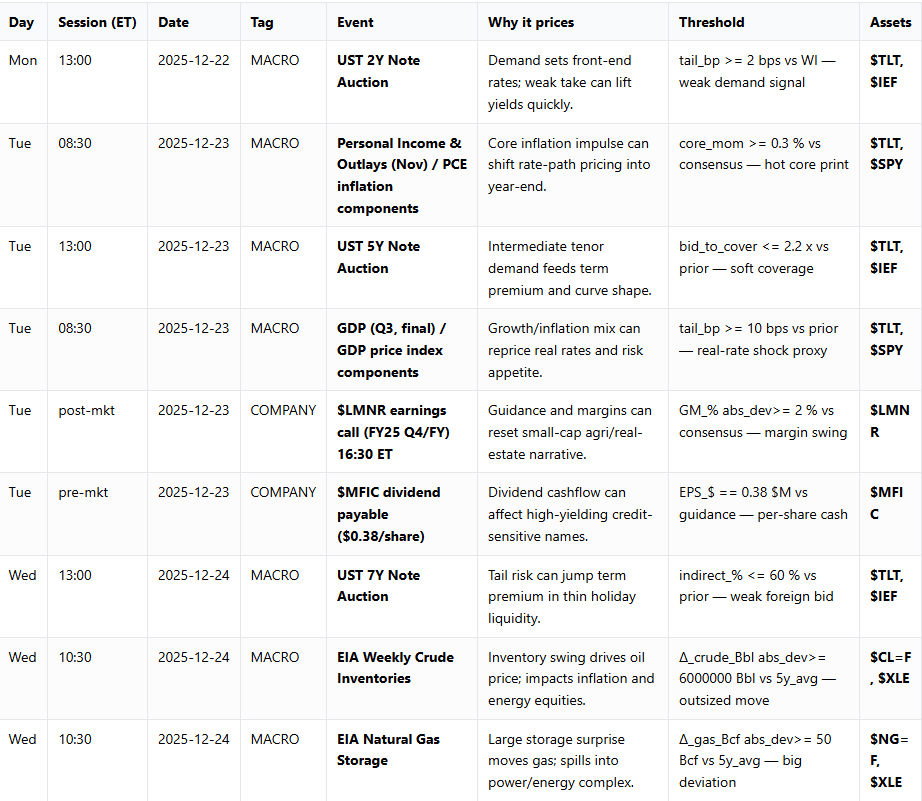

Next week centers on US inflation, growth mix, and Treasury supply in thin holiday liquidity. The key macro print is Tuesday’s Personal Income & Outlays/PCE (materiality 90): a core PCE ≥0.3% m/m would challenge the current 2.7% CPI disinflation narrative and could push $TLT lower and $DXY higher via a higher real-rate path. Auctions matter as well: a 2Y tail ≥2 bps on Monday (score 86) or a 5Y bid-to-cover ≤2.2x on Tuesday (84) would signal weak demand and lift term premia. Wednesday’s 7Y auction (indirects ≤60%) and EIA oil/gas surprises (±6M bbl, ±50 Bcf vs 5y avg) can amplify moves in $CL=F, $NG=F, and $XLE given reduced depth.

Company Look

Company-specific catalysts are light and liquidity-driven. Tuesday’s $LMNR Q4 earnings (post-mkt, GM deviations ≥2 ppt vs consensus) primarily reprice a single small-cap, but guidance on margins and agri/real-estate exposure can signal how softer inflation and rates filter into niche cyclicals. The rest of the calendar is about market microstructure: early closes for US equities at 13:00 ET and bonds at 14:00 ET on Wednesday, a full US market closure Thursday, and Friday’s reopen. Shortened cash hours (equity session length cut ≥2.5 “units” vs prior) and a 0-hours closure on Thursday raise gap risk, thin order books, and potential yield gaps ≥3 bps in $TLT/$IEF, making futures and FX the main risk-transfer channels.