PickAlpha Weekend - Look Into Next Week! | 2026-02-14

1) Weekly Recap • 2) Look Into Next Week | Watchlist: $SPY $DXY $IEF $SOXX $XLE $QQQ $XLY $CL=F $TLT $FXI $NG=F $UNG $TIP $EZU $PANW $CDNS $ADI $BKNG •

Weekly Recap

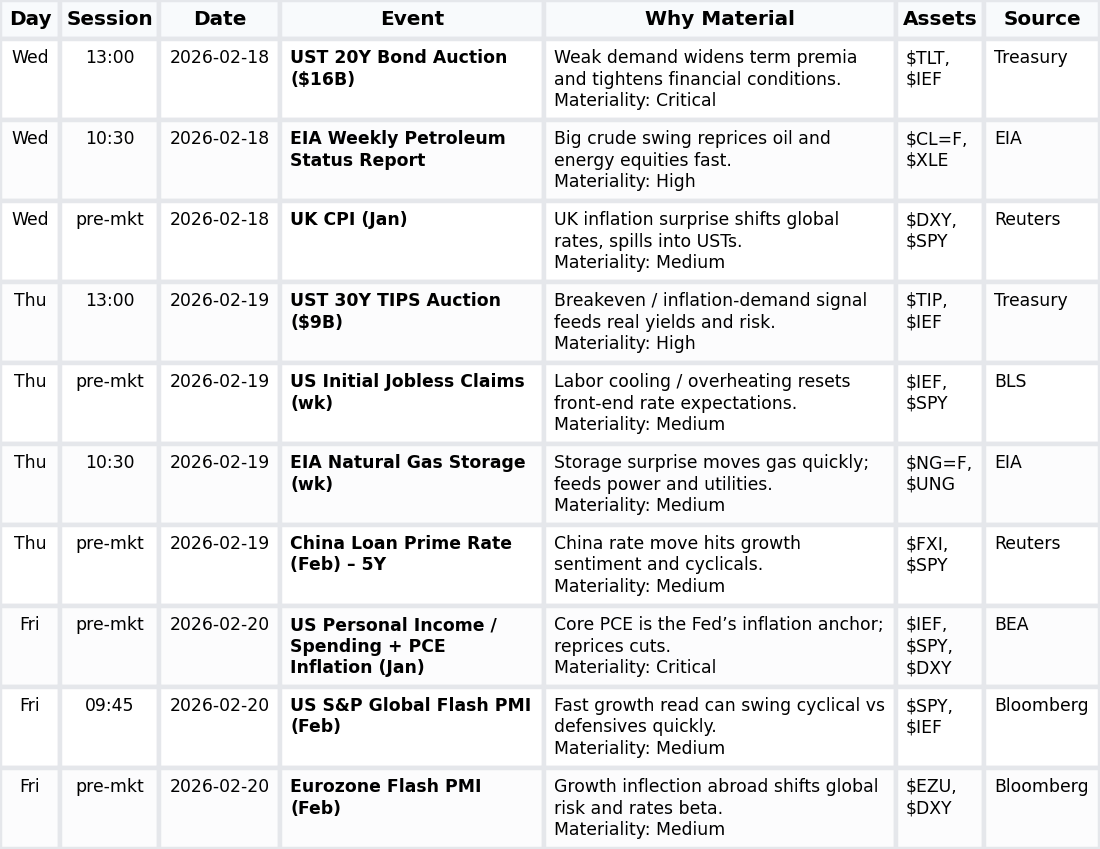

At a glance — Key events

• Softer Jan CPI at +0.2% m/m pulled 10Y yields -18 bps and DXY -0.7% — $TLT, $DXY, $SPY

• January payrolls +130K but 2025 jobs revised -898K, clouding Fed path and growth tone — $SPY, $QQQ, $TLT

• $42B 10Y and $25B 30Y auctions with BTC 2.39 and 2.66 contained term premia — $IEF, $TLT, $DXY

Equities faded despite friendlier inflation and lower yields. S&P 500 fell 1.4% w/w (6,932.30 → 6,836.17) and Nasdaq 2.1%, with VIX up 16.0% to 20.60. January CPI at +0.2% m/m and 2.4% y/y, plus core at 2.5% y/y, reinforced a disinflation narrative and pulled the 10Y to 4.04% (-18 bps). But the January Employment Situation—headline payrolls +130K against an 898K downward revision to 2025 jobs and unemployment at 4.3%—left the growth backdrop ambiguous, limiting multiple expansion in $SPY and $QQQ.

Rates and FX adjusted more cleanly. UST 2Y fell 10 bps to 3.40% and the 10s–2s curve flattened ~8 bps (~72 → ~64 bps), helped by a $42B 10Y auction (BTC 2.39, ~64.6% indirects) and a $25B 30Y (BTC 2.66). The ECI at 0.7% q/q and 3.4% y/y, plus softer import prices (+0.1% m/m) and still‑benign oil (WTI -1.0% w/w; EIA crude +8.5M bbl to 428.8M bbl), supported lower term premia and a 0.7% DXY decline, even as Energy ($XLE +2.1%) diverged from crude.

Look Into Next Week

Macro Look

Next week is macro-heavy around inflation, growth and supply: UK CPI, US PCE, PMIs and two UST auctions should mainly reprice rates, USD and broader risk. Energy balances via EIA reports could add volatility in $CL=F and $XLE after this week’s 8.5M‑bbl crude build.

• UST supply (AUCTION; $16B 20Y, $9B 30Y TIPS) — numeric anchor: $25B; tail/BTC drive term premia → rates → $TLT, $IEF

• Energy balances (EIA; oil and gas) — numeric anchor: N/A; inventory surprises move curves → energy earnings → $CL=F, $XLE, $UNG

• Growth pulse (ISM; US and Eurozone PMIs) — numeric anchor: N/A; PMI swings growth expectations → risk appetite → $SPY, $EZU, $IEF

• Fed inflation gauge (PCE; US Jan core) — numeric anchor: N/A; core PCE shifts cut odds → front-end yields/USD → $IEF, $SPY, $DXY

• Labor flow (CLAIMS; weekly) — numeric anchor: N/A; claims adjust labor-cooling narrative → Fed path → $IEF, $SPY, $DXY

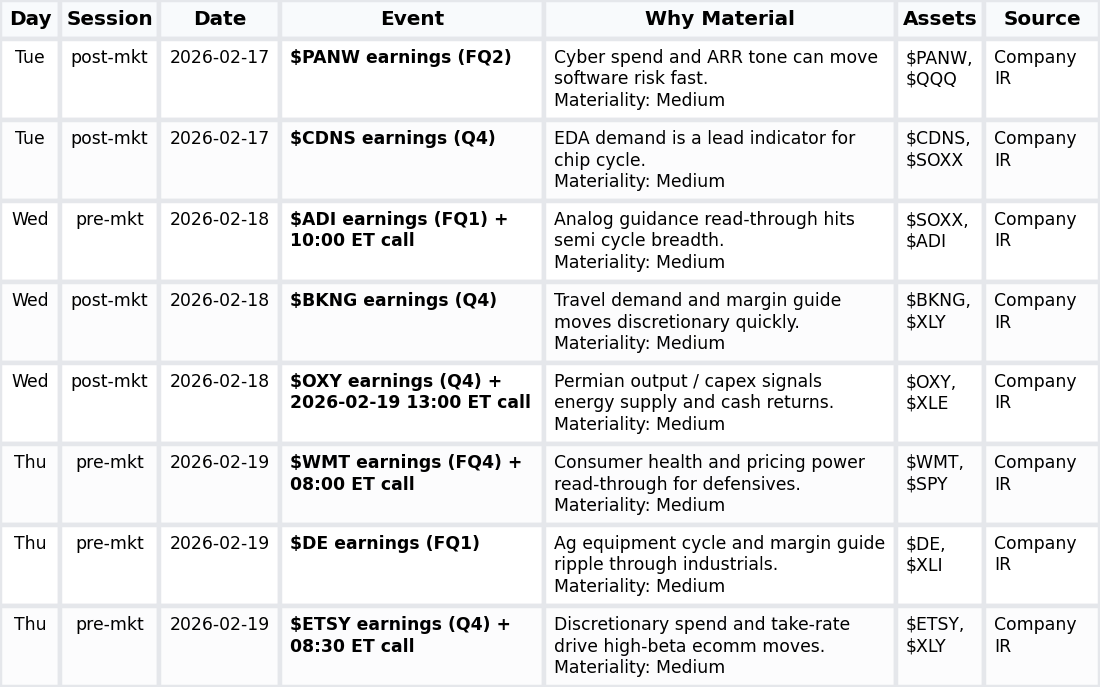

Company Look

Next week is sector‑dispersion rather than broad index‑beta driven: earnings from software/semis, consumer, industrials and energy should steer style and sector rotation more than the headline indices.

• Earnings — from $PANW, $CDNS, $ADI, $BKNG, $OXY, $DE, $WMT, $ETSY — numeric anchor: N/A; results/guidance steer growth, margins and capex expectations → sector leadership and index breadth in $QQQ, $XLY, $XLE, $XLI, $SPY