PickAlpha Weekend - Look Into Next Week! | 2025-11-29

What actually priced this week, and what likely prices next. Sections: 1) Weekly Recap • 2) Look Into Next Week

Weekly Recap

At a glance — Key events:

• Fed cut odds rose toward 87%; 10Y -7 bps, DXY -0.7%, S&P 500 +3.7% — $SPY $DXY

• Dell/Autodesk AI guidance beats supported tech; Nasdaq +4.9% vs Russell 2000 +5.5% — $QQQ $IWM

• EIA crude build +2.8M bbl, imports at 11-week high pressured XLE despite Brent near $63/bbl — $CL=F $XLE

• CME outage froze futures for ~11 hours; VIX ended 16.35 with limited lasting damage — $ES=F $NQ=F

• DXY slid to ~99.44, its worst week since July, as December cut odds hit ~87% — $DXY $GLD

Equities traded a clean “rates down, growth up” pattern. Fed commentary and softer U.S. retail, PPI and confidence pushed December cut odds into the ~80–87% range, taking 2Y yields down ~4 bps and 10Y about 7 bps. The S&P 500 gained 3.7%, with the Nasdaq up 4.9% and Russell 2000 5.5%, as lower discount rates supported long-duration tech and SMID. AI- and software-linked beats from Dell and Autodesk, plus still-firm U.S. jobless claims at 216k and 0.9% core capex growth, reinforced a soft-landing narrative.

The dollar weakened as policy expectations shifted. DXY fell 0.7% to about 99.46 and roughly 0.61% on the week toward 99.44, its largest drop since July, helped by Canada’s 2.6% Q3 GDP beat and euro-area inflation around 2.1%. In energy, an unexpected +2.8M-barrel U.S. crude build and 11‑week high imports undercut WTI even as Brent held above $63/bbl; Ukraine’s later strike on Black Sea flows (over 1% of seaborne supply) added upside risk into the weekend. A rare ~11‑hour CME outage briefly disrupted futures hedging, but VIX finished at 16.35 and broader credit stayed calm.

Look Into Next Week

Macro Look

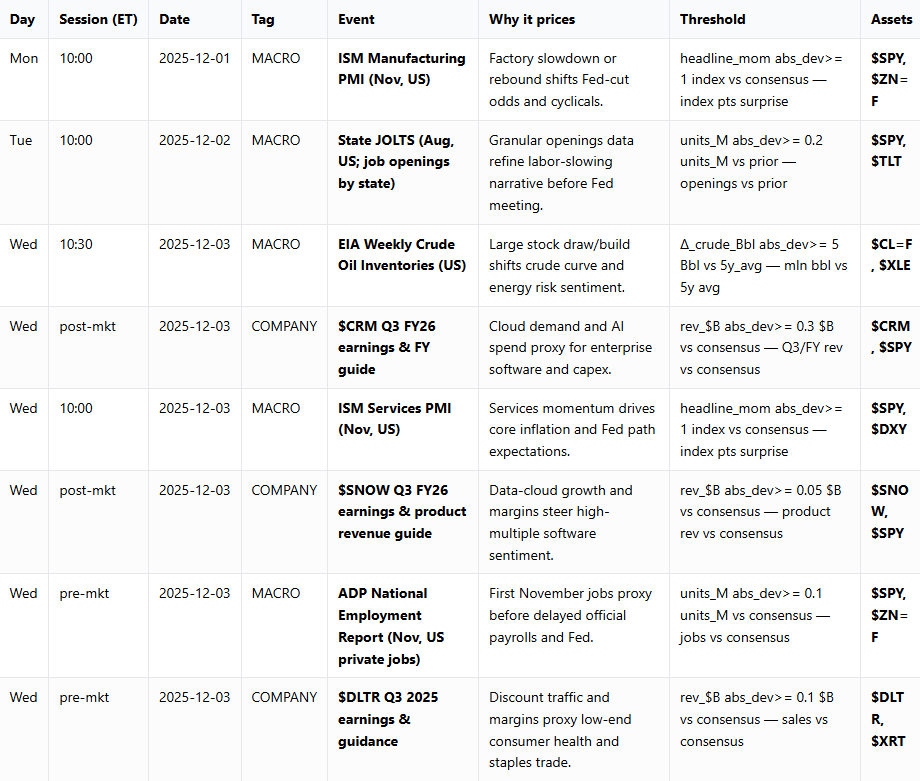

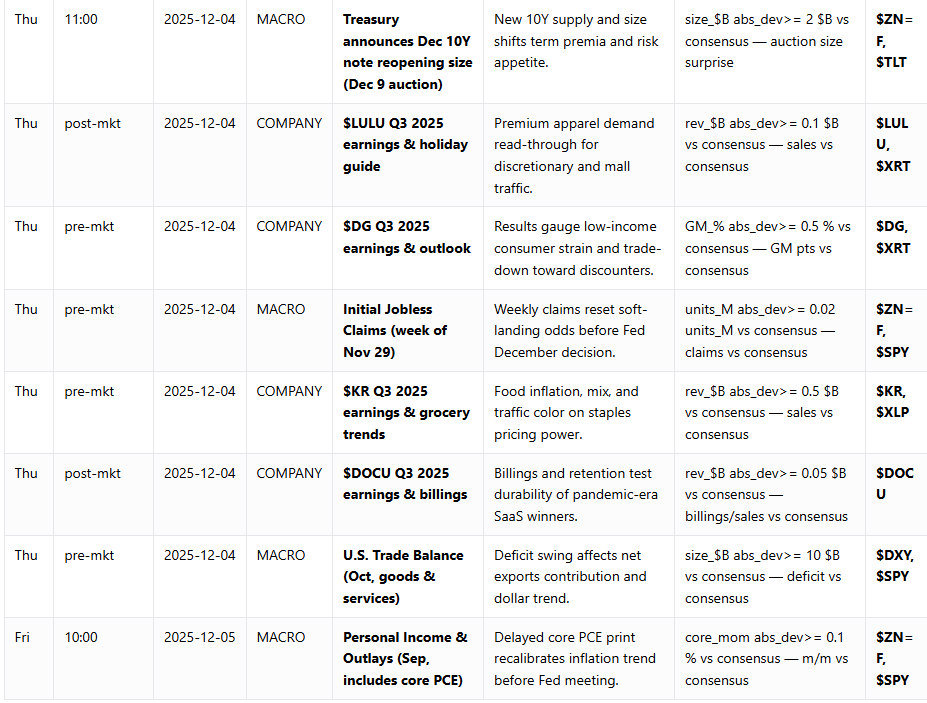

Macro focus shifts to how incoming data refine the already-high odds of a December cut. The most material is Friday’s Personal Income & Outlays report (core PCE; materiality_score 92), where a ±0.1ppt m/m surprise versus consensus could move 10Y yields and $ZN=F meaningfully. ISM manufacturing and services (both ±1 index‑point thresholds; scores 82 and 80) will test how much growth has slowed beneath the equity rally. ADP jobs, weekly claims (±0.02M vs consensus), and state JOLTS round out the labor picture ahead of the Fed. EIA’s weekly crude print (±5M bbl vs 5‑year average) and the 10Y reopening size (≥$2B surprise; score 88) are key for term premia, $CL=F, $XLE and the dollar.

Company Look

Next week’s company tape is retail- and software-heavy, with read-throughs for consumer health and growth valuations. On Wednesday, $DLTR pre‑market earnings (≥$0.1B sales surprise) and post‑market $CRM and $SNOW (≥$0.3B and ≥$0.05B revenue thresholds) will show whether cloud/AI spend is broadening beyond this week’s Dell/Autodesk strength. Thursday’s pre‑market $DG and $KR (≥0.5ppt gross‑margin or $0.5B sales surprise) will color low-end trade-down, food inflation and staples pricing power. Post‑market, $LULU and $DOCU (≥$0.1B / $0.05B sales or billings beats) will help gauge premium discretionary demand and the durability of high-multiple SaaS, with potential gap risk around guidance.