PickAlpha Weekend - Look Into Next Week! | 2026-01-24

1) Weekly Recap • 2) Look Into Next Week | Watchlist: $SPY $TLT $DXY $QQQ $XLE $CL=F $NG=F $BA $SOXX $GEV $META $TSLA $IBM $XLF $ITA $ASML $XLI $MSFT •

Weekly Recap

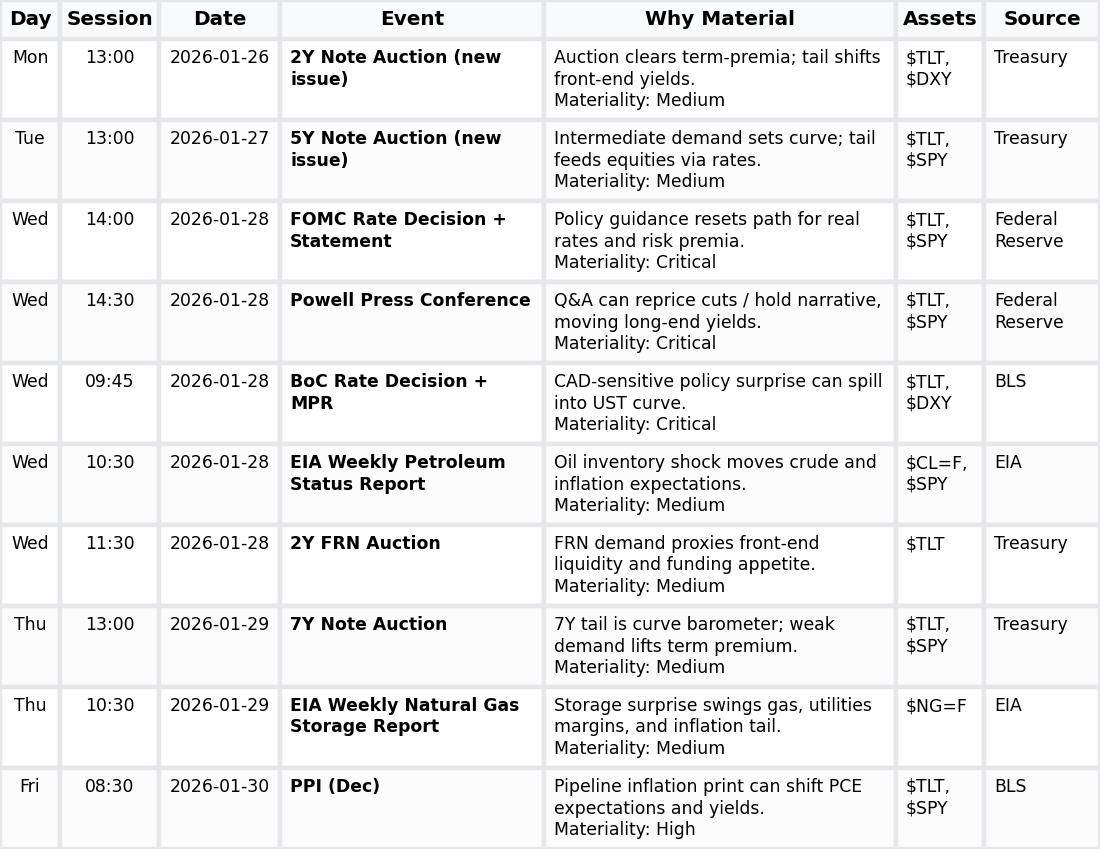

At a glance — Key events

• Greenland tariff shock drove S&P -2.2% Tuesday and VIX 20.1 before mean reversion — $SPX, $VIX

• China Q4 GDP slowed to 4.5% YoY, capping upside for EM beta — $FXI, $EEM

• 20Y UST auction sized $13.0B cleared at 4.846% with 2.86x BTC, term-premium contained — $TLT, $IEF

• Core PCE running near 2.8% YoY kept rate‑cut hopes in check despite solid spending — $SPY, $TLT

Macro data pointed to late‑cycle but still‑resilient growth. China Q4 GDP at 4.5% YoY and full‑year 5.0% reduced hard‑landing fears but underlined structural drag for EM and cyclicals like $EEM and $CAT. In the US, real PCE grew about 0.30% over Oct–Nov with core PCE near 2.8% YoY, while initial jobless claims at 200k versus 210k consensus signaled a tight labor market. BEA’s 4.40% Q3 state‑GDP growth and 3.30% income gains supported broad equity earnings power even as the LEI fell 0.30%, flagging maturing‑cycle conditions.

Policy and risk events dominated cross‑asset pricing more than rates. Trump’s planned Europe/Greenland tariffs drove a one‑day S&P -2.2% drawdown and pushed VIX as high as 20.99 before retracing; record‑high gold and Goldman’s lift of its end‑2026 target to $5,400/oz kept $GLD and $GDX bid. USTs were stable, with the $13.0B 20Y auction clearing at 4.846% and 2.86x BTC. Supreme Court arguments in Trump v. Cook appeared to reduce near‑term odds of a disruptive Fed reshuffle, helping anchor $ZN=F, $ZB=F and $DXY. Oil inventories rose 3.6M bbl to 426.0M, yet WTI gained 2.7%, supporting $XLE.

Look Into Next Week

Macro Look

A packed week centers on Fed communication and Treasury supply, with auctions and the FOMC decision likely driving rates and the USD. Energy balances via EIA reports and Friday’s PPI will refine inflation expectations and thus risk premia across $TLT, $DXY and $SPY.

• UST auctions (2Y, 5Y, FRN, 7Y; total materiality_score 312) — numeric anchor: 4 auctions; curve demand → term premium → $TLT, $SPY

• Central‑bank communication (BoC + FOMC + Powell; score 280) — numeric anchor: FOMC score 98; policy surprises → rate expectations → $TLT, $DXY

• Energy balances (oil, gas EIA; score 145) — numeric anchor: 2 EIA prints; inventory shocks → commodities → inflation beta → $CL=F

• Inflation pipeline (Dec PPI; score 85) — numeric anchor: N/A; PPI surprise → PCE expectations → yields/multiples → $TLT, $SPY

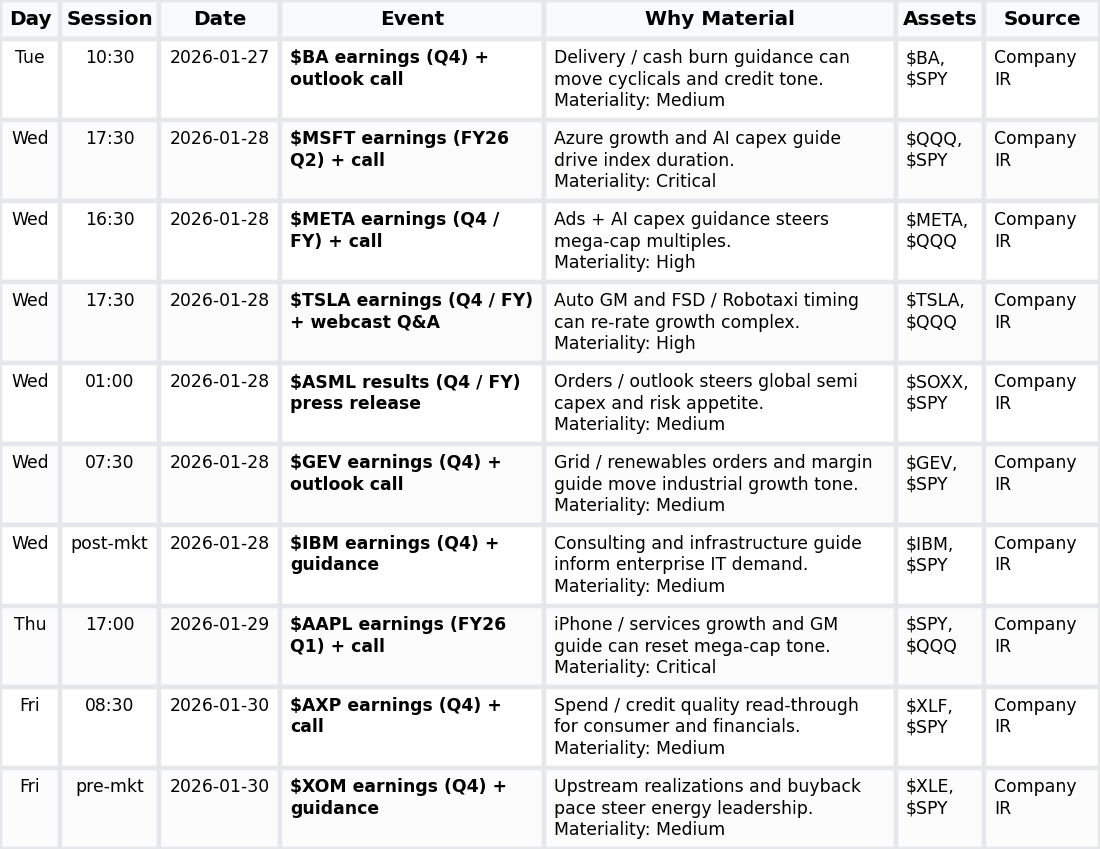

Company Look

Next week is index‑beta driven, with mega‑cap tech and large platforms dominating tape direction. Earnings concentration in $MSFT, $AAPL, $META, $TSLA and $ASML will set growth‑and‑AI expectations, while cyclicals, energy and financials prints fine‑tune sector dispersion within $SPY and $QQQ.

• Mega‑cap tech earnings (MSFT, AAPL, META, TSLA, ASML) — numeric anchor: N/A; AI/revenue guidance → growth expectations → $QQQ, $SPY

• Industrial/cyclical earnings (BA, GEV) — numeric anchor: N/A; delivery/margin tone → industrial cycle views → $XLI, $SPY

• Financials/consumer earnings (AXP) — numeric anchor: N/A; spend/credit trends → financials breadth → $XLF, $SPY

• Energy majors earnings (XOM) — numeric anchor: N/A; upstream profits/buybacks → energy leadership → $XLE, $SPY

Informational only; not investment advice or a recommendation to buy or sell any security.

Really like the framing of next week as "index-beta driven" — that concentraton in MSFT/AAPL/META/TSLA creates some pretty wild convexity in QQQ. When five names can move the whole index, even modest earnings suprise start to feel binary. The FOMC decison adds another layer too, since any hawkish tilt could amplify downside if tech guidance dissapoints.