PickAlpha Weekend - Look Into Next Week! | 2025-12-13

What actually priced this week, and what likely prices next. Sections: 1) Weekly Recap • 2) Look Into Next Week

Weekly Recap

At a glance — Key events:

• Curve steepened as 10Y rose to 4.19% while 2Y fell to 3.52%; growth beta lagged — $TLT, $SPY

• AVGO −11.4% Friday drove Tech −2.3% w/w; semis underperformed broader indices — $SOXX, $QQQ

• Fed cut 25 bps to 3.50–3.75% while VIX ranged 14.85–17.85; risk premia reset — $SPY, $VIX

• WTI −0.3% w/w despite a 2.51mn bbl EIA crude draw; products built — $CL=F, $XLE

Rates and macro policy dominated the backdrop. The Fed’s 25 bp cut to 3.50–3.75%, combined with the NY Fed’s planned ~$40bn/month T-bill purchases, kept front-end yields anchored even as the 10Y rose 5 bps to 4.19%. A 3‑year auction at 4.198% with 2.54× bid‑to‑cover and 63.99% indirects reinforced demand in the 2–3Y sector, helping the 2Y fall 4 bps to 3.52% and steepening 2s10s by about 9 bps. Jobless claims at 236k added growth‑risk chatter but did not fully override the policy‑easing signal.

Equities saw a factor rotation rather than an outright crash. The S&P 500 slipped 0.6% while the Nasdaq fell 1.6%, contrasted with Russell 2000 up 1.2%, as Financials gained 2.3% and Tech lost 2.3% on the week. AVGO’s 11.4% Friday drop and AI‑margin fears weighed on $SOXX and $QQQ despite Anthropic’s ~$21bn chip order extending AI capex visibility. Volatility spiked intraday Friday (VIX high 17.85) before closing at 15.74. In energy, a 2.51mn‑bbl EIA crude draw and 177 Bcf gas withdrawal supported upstream, but gasoline (+3.96mn bbl) and distillate (+1.17mn bbl) builds capped refiners.

Look Into Next Week

Macro Look

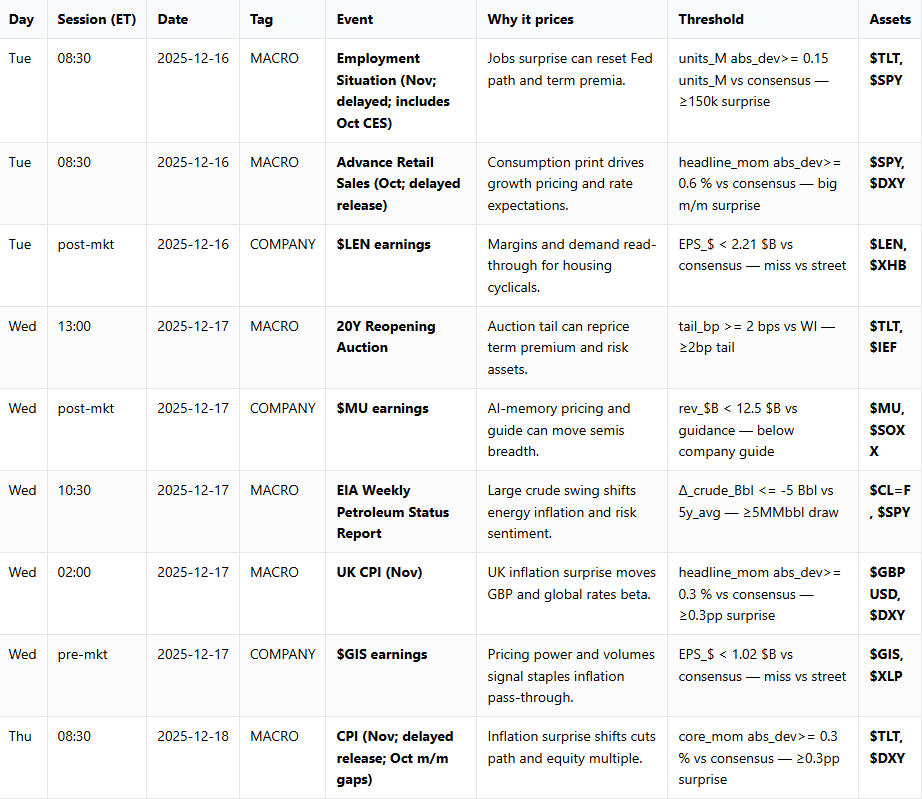

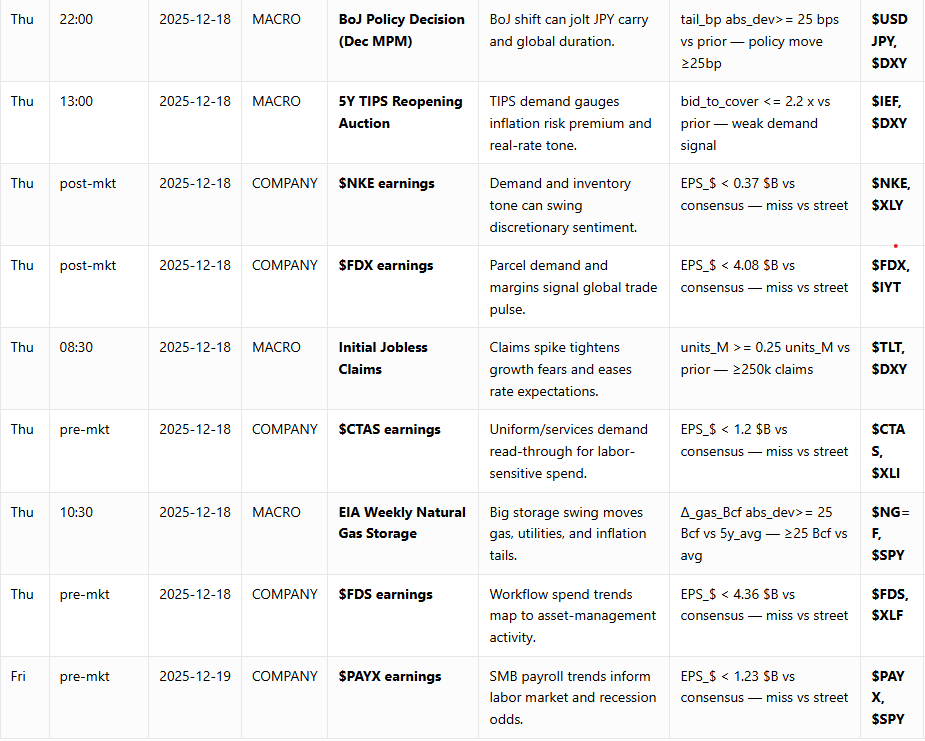

Next week’s macro tape clusters around U.S. labor, inflation, and supply. The delayed November Employment Situation and October payroll revisions (materiality_score 92) share the Tuesday 08:30 ET window with October Advance Retail Sales (score 80), so a ≥0.15M NFP surprise or ≥0.6% m/m sales deviation could quickly reprice growth and the cuts path, moving $TLT and $DXY. Wednesday’s 20Y reopening (score 86) will test term‑premium appetite; a ≥2 bp tail vs WI would challenge this week’s 2s10s +9 bp steepening. Thursday’s CPI (score 94) is the key macro pivot: a ≥0.3pp core surprise would likely dominate both USD and long‑end direction, with EIA crude and gas prints providing energy‑beta and inflation‑tail reinforcement.

Company Look

Company catalysts are concentrated but macro‑sensitive. In housing, $LEN’s Tuesday post‑market earnings (score 72) will show whether margins and demand still support $XHB after the Fed’s third 25 bp cut. Staples tone comes from $GIS Wednesday pre‑market (score 70), where EPS and GM outcomes versus $1.02 consensus will test pricing power in $XLP. Semis leadership faces a key read with $MU Wednesday post‑market (score 84); revenue vs $12.5B guidance and GM could either validate or challenge this week’s AVGO‑driven AI‑margin reset in $SOXX. Thursday brings read‑across on services ($CTAS), data/financials ($FDS), transports ($FDX), and discretionary ($NKE), with pre‑/post‑market timing shaping gap risk for $XLI, $XLF, $IYT, and $XLY.