The Odds Trump “Takes” Greenland Are Much Higher Than You Think – But Probably Not the Way You Imagine

What It Means for Markets

Executive Take

Most commentary hears “take Greenland” and defaults to a territorial frame: annexation, purchase, or coercive transfer. That is unlikely to be the modal outcome. The more implementable path is a negotiated package that upgrades U.S. access into something closer to de facto control, while formal sovereignty remains with the Kingdom of Denmark and Greenland’s self-rule narrative stays intact.

The underlying objective is operational certainty and durability, not a flag-planting event. Many of the practical goals implied by “ownership” can be achieved through updated defense arrangements, infrastructure funding, and procurement frameworks. That is why we think a “win” headline is entirely plausible even if nothing like a traditional takeover occurs. This is consistent with the core critique in Bloomberg Opinion: if Washington can “rent” the strategic value through agreements, the logic of “buying” the territory is weaker.

Investment implications (takeaway)

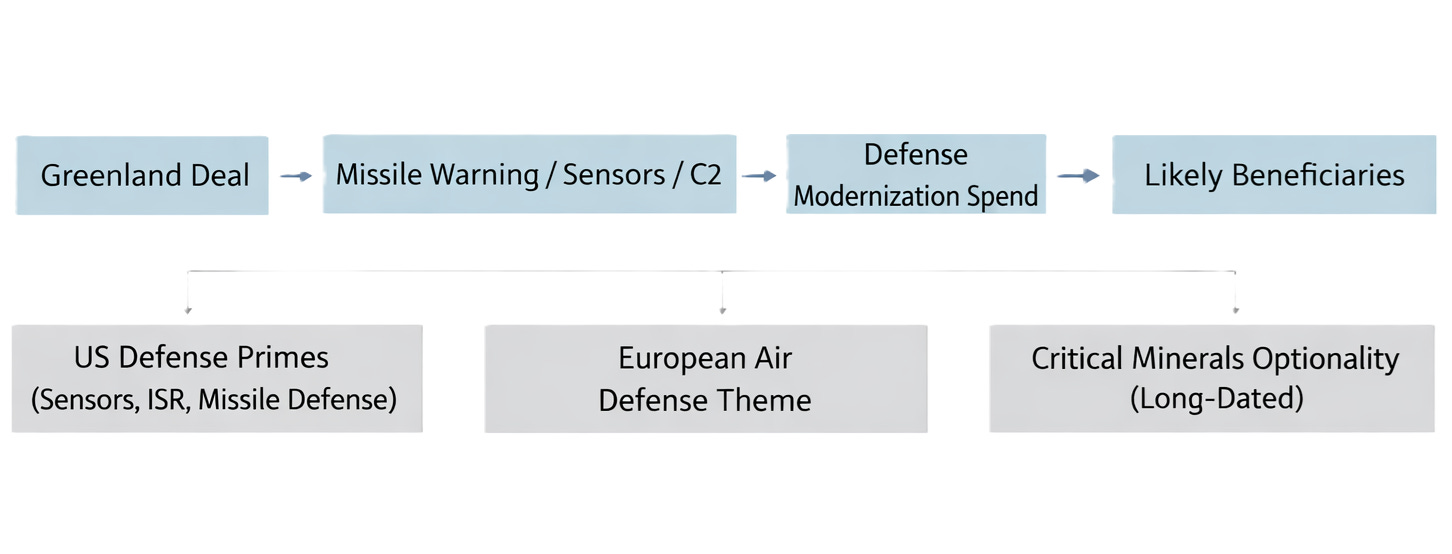

Primary beneficiary: U.S. defense modernization tied to missile warning, sensors, and C2 networks anchored by Pituffik’s mission set.

Second-order: European defense spending momentum, if the episode accelerates NATO “High North” posture and air and missile defense priorities.

More speculative: long-dated critical minerals optionality, likely trading as equity optionality rather than an immediate commodities impulse.

Background: Why Greenland Became a “Big Deal” Again

Greenland’s return to the top of the agenda is an old storyline colliding with a more operational Arctic environment.

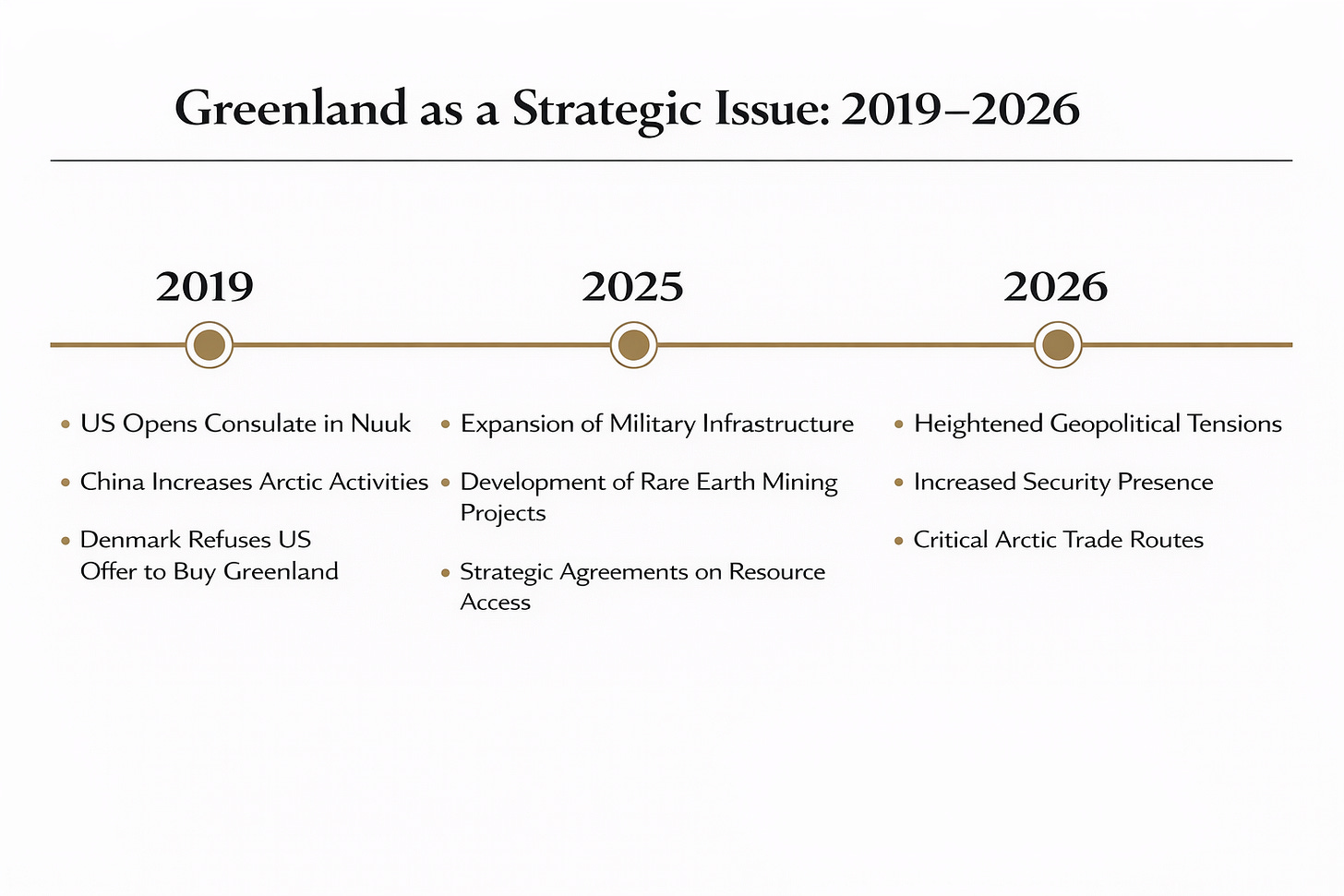

First, there is a clear precedent. The idea of U.S. acquisition of Greenland surfaced publicly in 2019 and was rejected by Danish and Greenlandic leaders. That episode matters because it proved the issue can be elevated quickly into a presidential-level bargaining chip, and that “ownership” rhetoric triggers immediate sovereignty sensitivities even when security cooperation is welcome.

Second, the strategic context has intensified. The Arctic has shifted from a distant strategic theater to an operational planning problem, covering surveillance, early warning, routes, infrastructure, and presence. Recent rhetoric has explicitly tied Greenland to national security and great-power competition. At the same time, allied and regional voices have pushed back on specific threat narratives. That tension is a feature, not a bug. A heightened threat frame expands the U.S. negotiating set, while allies seek to keep outcomes compatible with alliance cohesion.

Third, Greenland’s domestic politics has been unusually explicit. Greenland’s parliament has underscored that Greenland’s future must be decided by Greenlanders, and it has rejected the idea of being “traded.” This sets a key constraint. Deeper cooperation is negotiable, but a sovereignty narrative that resembles a transaction is politically toxic.

Finally, this is not a blank slate. The U.S. already has a strategically critical footprint via Pituffik Space Base, historically central to missile warning and space surveillance missions. The debate is therefore not whether the U.S. can operate in Greenland. It is how much more certainty and latitude the U.S. can lock in, and how that expansion is legitimized politically and institutionally.

Though autonomous, Greenland plays a key role In U.S. and NATO Arctic Strategy, especially for missile defense and early-warning systems.

(Photo Credit: Unbox Factory)

The Core Question: If the U.S. Already Has Access, Why Push “Ownership”?

The starting point is straightforward. Denmark is a NATO ally, and the U.S. already operates key capabilities in Greenland. So why escalate rhetoric to “ownership”?

The clean answer is access ≠ control.

From a hard-security planner’s point of view, the friction isn’t “can we be there?” It’s whether the U.S. can:

expand and modernize sensors/infrastructure on faster timelines,

reduce political and procedural uncertainty around upgrades,

tighten investment and infrastructure screening to exclude strategic competitors, and

lock in long-dated economic arrangements (e.g., procurement/offtake, financing, dual-use infrastructure) that make U.S. presence more durable and less contingent.

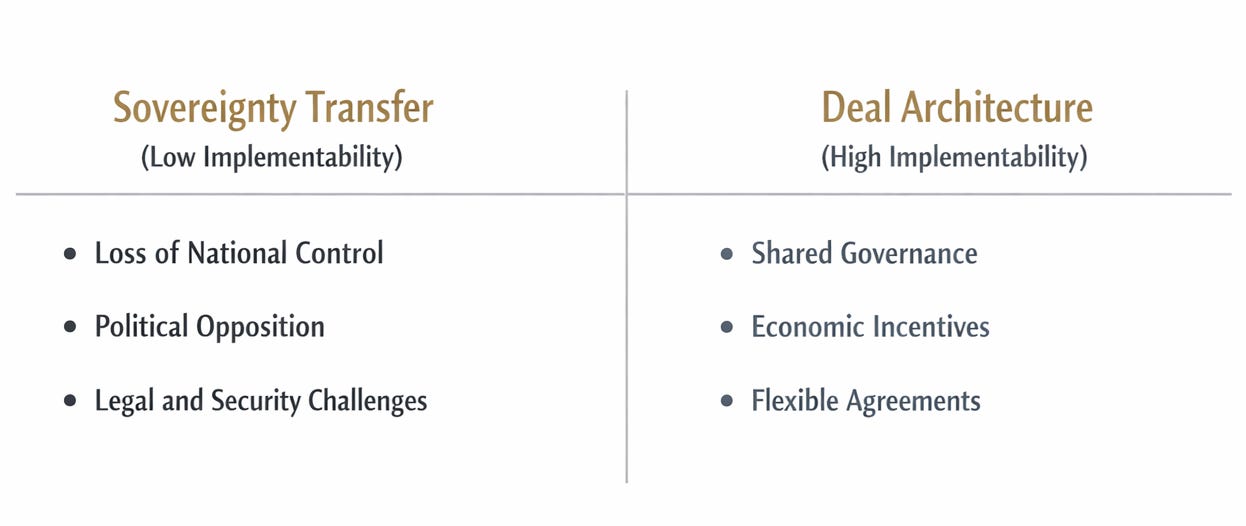

This is where “ownership” becomes a negotiating instrument rather than a legal blueprint. High-intensity rhetoric can compress the bargaining range toward outcomes that feel control-like in practice, even if formal sovereignty never moves. A deal architecture can convert today’s access into higher-certainty permissions, accelerated capability expansion, stronger exclusion mechanisms, and durable economic alignment.

Bottom line, the most implementable “Trump wins Greenland” outcome is not a sovereignty event. It is a negotiated package that expands U.S. operational latitude and economic alignment while preserving a Denmark and Greenland narrative centered on sovereignty, self-rule, and self-determination.

Why a Traditional “Take” Is Unlikely

A sovereignty transfer is the least executable endpoint because it runs into three hard constraints: alliance cohesion, domestic legitimacy, and procedural complexity.

Alliance cohesion. Denmark is a NATO ally and Greenland sits inside the Kingdom of Denmark’s constitutional structure. A forced sovereignty outcome would turn an Arctic security question into an intra-alliance crisis. The U.S. would take disproportionate diplomatic damage across Europe for limited incremental operational benefit, since meaningful cooperation already exists and can be expanded through alliance-compatible mechanisms.

Domestic legitimacy in Greenland. Greenland’s politics is anchored in self-determination and identity. Any outcome that reads like territorial trade is politically toxic for local actors who must sustain it across election cycles. Even leaders open to deeper U.S. engagement face strong incentives to reject a deal that can be framed as subordination rather than partnership.

Procedural complexity. A formal sovereignty shift is not a single signature. It is a layered, high-veto process that must survive parliamentary scrutiny and political turnover. That makes the path slow, fragile, and easily derailed by a single domestic shock. By contrast, many of the practical objectives implied by the rhetoric can be pursued through agreements and programs that are operationally faster and politically more survivable.

The implication is a simple asymmetry. The most provocative rhetoric maps to the least implementable endpoint, while the most implementable endpoint can still deliver control-like outcomes in practice. That asymmetry is exactly why the “deal path” deserves a higher probability weight than the “takeover path.”

Our Hypothesis: “Trump Wins” Through a Package Deal That Looks Like Control

Our base case is that “Trump takes Greenland” resolves into a negotiated package that materially expands U.S. operational latitude and economic alignment, while leaving sovereignty unchanged.

The package is likely to be framed as modernization of Arctic defense and development, with three visible deliverables. First, clearer basing and construction pathways and a defined scope of capability upgrades. Second, a multi-year infrastructure and security assistance commitment that reduces Arctic operating constraints. Third, an economic framework that aligns sensitive investment screening and secures long-dated optionality in critical minerals through financing and offtake.

This hypothesis rests on a feasible win-set for each party. The U.S. can claim enhanced security posture and a tangible deal. Denmark can frame the outcome as burden-sharing and alliance strengthening without conceding sovereignty. Greenland can secure investment and infrastructure while sustaining a self-determination narrative. The agreement can be designed to be politically survivable because it avoids an explicit territorial transaction.

The primary risk is domestic politics in Greenland. A package can still fail if it is perceived as subordination rather than partnership. A second risk is rhetorical overshoot. If U.S. messaging implies sovereignty outcomes that allies cannot endorse, it narrows the bargaining space and increases the probability of stall rather than deal.

Market Implications: What a Signed “Control-Like” Greenland Deal Would Likely Benefit

The core pricing mechanism

A deal that expands U.S. operational latitude in Greenland is best understood as a homeland missile-warning and Arctic posture upgrade. That links most directly to sensors, early-warning radars, C2, and missile-defense architecture tied to Pituffik’s role in the U.S. early-warning network.

5.1 First-order winners: U.S. defense primes with sensor, radar, and missile-defense exposure

Why it benefits: A Greenland deal that accelerates capability expansion should pull forward spending on early-warning radar sustainment and modernization, plus enabling infrastructure. The Missile Defense Agency’s FY2026 budget materials explicitly reference the Upgraded Early Warning Radar network including Pituffik Space Force Base (Greenland) and related sustainment/modernization items.

What to own (U.S.):

RTX (Raytheon) as the most obvious “radar and sensors” beneficiary (historical precedent: Raytheon as a prime on Greenland early-warning radar upgrades).

L3Harris (LHX) for C4ISR and sensor-network plumbing (deal logic is “more persistent sensing + more comms + more integration”).

Northrop Grumman (NOC) and Lockheed Martin (LMT) as “architecture primes” that typically gain when missile-defense and space-domain programs accelerate; defense equities have already been bid on the broader theme of higher spending and geopolitical tension.

Trade framing: This is less “new war” and more “accelerated capex + sustainment and modernization.” The sensitivity is to budget follow-through, not to headlines.

5.2 Second-order winners: European defense (if the deal is paired with Europe shifting toward Arctic/NATO self-reliance)

Why it benefits: Even if the end-state is a negotiated package, the episode reinforces Europe’s incentive to spend more on self-reliance and air/missile defense. Bloomberg commentary has explicitly tied the Greenland rhetoric to an acceleration of Europe’s shift toward self-reliance.

What to own (Europe): names geared to air defense, sensors, and munition re-stocking typically screen best (examples: BAE Systems, Rheinmetall, Saab, Thales, Leonardo).

What makes this real: confirmation that Berlin/London push for a NATO Arctic mission or incremental deployments in/around Greenland would harden the spending narrative.

5.3 Third-order and more speculative: Rare earth and critical minerals optionality (but long-dated and infrastructure-constrained)

Why it could benefit: A deal that tightens U.S. alignment with Greenland can be interpreted as future supply-chain optionality for non-China critical minerals. That story resonates because China’s export controls and magnet restrictions have been tightening, keeping Western “mine-to-magnet” efforts politically supported.

Why it is not a near-term commodity trade: Greenland mining is structurally difficult. Reporting emphasizes harsh conditions and lack of infrastructure as binding constraints on rare earth development, which makes the payoff multi-year and policy-dependent.

How it trades anyway: this tends to show up as valuation rerating in “policy-leverage” names rather than spot price moves. A concrete example is Critical Metals (CRML) with Greenland exposure, where Reuters has previously reported U.S. discussions about an equity stake, and Bloomberg has covered Trump-linked interest in Greenland rare-earth ambitions.

More defensible basket approach: pair high-beta Greenland-exposed optionality with more established Western supply-chain plays (e.g., MP Materials (MP)) rather than betting purely on Greenland project execution.

5.4 Cross-asset: the clean conditional

If the outcome is a signed deal (alliance-compatible): modest risk-on, defense continues to grind higher on budget certainty; limited broad macro impulse unless spending materially surprises.

If rhetoric re-intensifies and alliance fracture risk rises: USD and U.S. duration can catch a bid as risk hedges, while European risk assets price a higher geopolitical premium. (This is the “tail-risk hedge” branch that matters for positioning.)

Thanks for reading.