Weekly Recap — Look Into Next Week! | 2025-10-19

Sections: 1) Weekly Recap • 2) Look Into Next Week • 3) Inference Review What actually priced this week, and what likely prices next.

Weekly Recap

Treasuries rallied into the end of the window, driving a modest bull‑steepen: 2Y −11 bps and 10Y −6 bps (Thu closes used). That fall in yields coincided with a weaker dollar (DXY −0.7%) and helped compress front‑end dollar funding claims amid a 17‑day U.S. government shutdown and 1.4k reported furloughs; policy risk appears to have supported haven demand and fed lower short yields. Growth signals were mixed: Empire State surprised to the upside at 10.7 while Philly fell to −12.8, leaving equities sensitive to regional divergence and maintaining VIX swings (range 18.6–29.0).

Commodity drivers diverged. Crude traded lower for the week (WTI ~−3%), as OPEC’s monthly note pointing to a smaller 2026 deficit offset Monday’s OFAC designations that raised near‑term execution risk for Iranian barrels (≈100 entities targeted). Energy data also mattered: EIA nat‑gas injections were +80 Bcf, sustaining the soft commodity narrative and pressuring front‑month spreads. On policy/regulatory fronts, the EU’s conditional clearance of Boeing’s $4.7bn Spirit deal reduced merger overhang, tightening arb spreads while U.S. approvals remain unresolved. This recap is informational only—not investment advice.

Look Into Next Week

Macro Look

Next week’s calendar centers on supply and price signals that can re‑price front-end rates and commodities. Treasury bill auctions (Mon, 11:30 ET; bid‑to‑cover ≥2.5x) and a 20‑year reopening (Wed; bid‑to‑cover ≥2.4x) test term premium and could push short yields and DXY either tighter or softer depending on demand. EIA/API reads (Tue API; Wed EIA petroleum) and nat‑gas storage (Thu 10:30 ET; ±7 Bcf vs 5y avg) will likely set crude and NG price direction—crude moves ±3–5 Mbbl in the EIA window would re-price energy names. CPI (Fri 08:30 ET; m/m ≥0.4% core ≥0.3%) is the largest Fed‑path risk; a hotter print would push DXY up and steepen rate expectations.

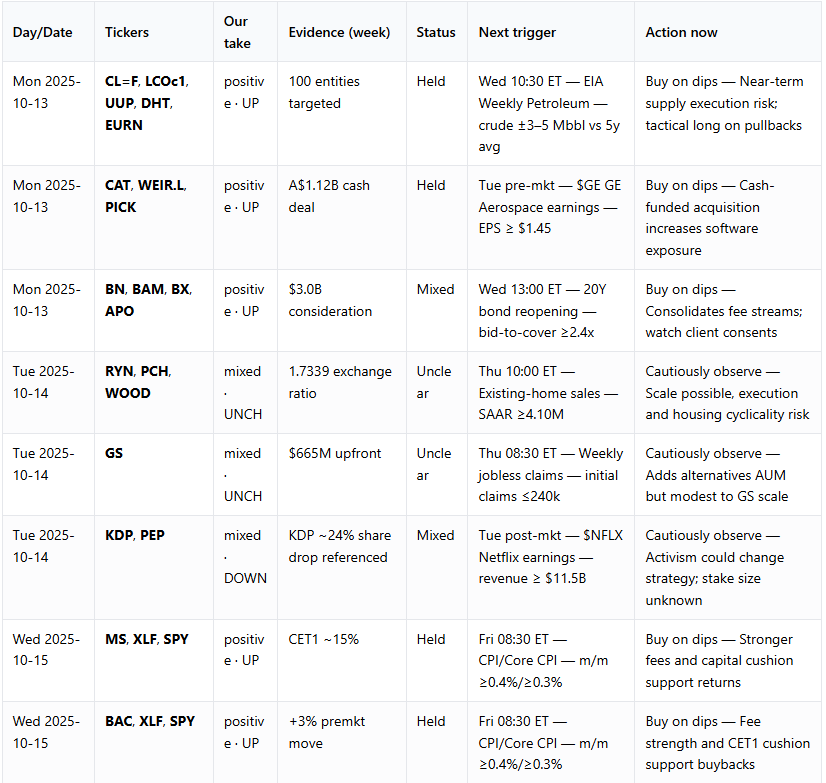

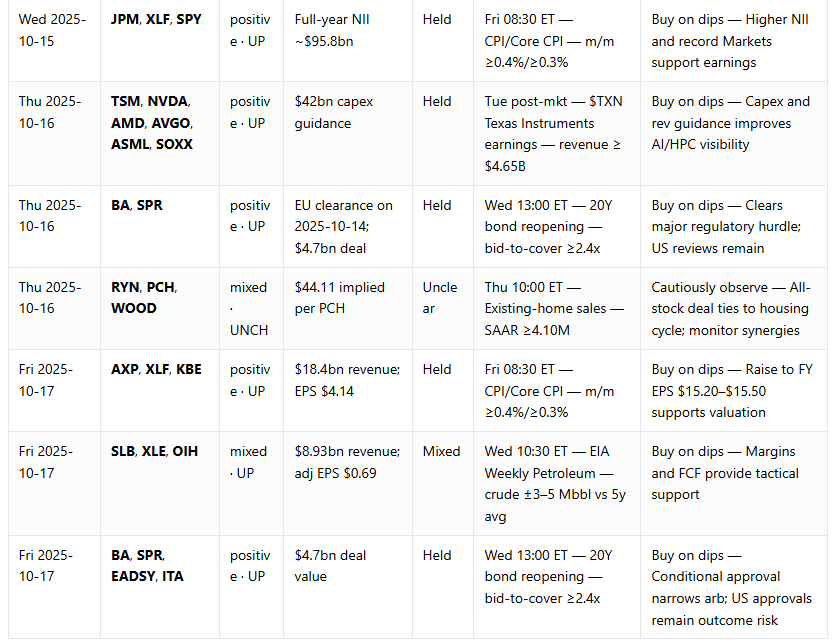

Company Look

Earnings focus next week is broad: industrials/aero (GE pre‑mkt Tue), autos (GM pre‑mkt Tue; Ford Thu post‑mkt), semis (TXN Tue post‑mkt; revenue ≥ $4.65B) and media/consumption (NFLX Tue post‑mkt; TSLA Wed post‑mkt). Guidance and margin commentary from TXN, GE and GM will transmit to SOXX, XLY and SPY via capex and auto cycle read‑throughs; NFLX/TSLA results will influence ad/ARPU and pricing expectations for consumer discretionary. Watch EPS/revenue beats versus the listed thresholds for signaled sector momentum.

#### Triggers

Wed 10:30 ET — EIA Weekly Petroleum — crude ±3–5 Mbbl vs 5y avg (EIA) — $CL=F, $XOP

Fri 08:30 ET — CPI/Core CPI — m/m ≥0.4%/≥0.3% (BLS) — $DXY, $SPY

Tue post-mkt — $TXN Texas Instruments earnings — revenue ≥ $4.65B (Company IR) — $TXN, $SOXX