Weekly Recap — Look Into Next Week! | 2025-10-26

What actually priced this week, and what likely prices next. Sections: 1) Weekly Recap • 2) Look Into Next Week • 3) Inference Review

Weekly Recap

U.S. inflation prints and a thin official-data window shifted the rate and FX backdrop: CPI undershot at 3.0% y/y (Sep), which pushed short-rate cut odds higher and left front-end yields relatively anchored (2Y +2 bps vs 10Y −1 bp), while the dollar finished the week stronger (DXY +0.9%). That mix flattened the curve (~−3 bps on 2s10s) and lowered long-term real yields (10Y TIPS −4 bps), supporting risk assets and tightening IG OAS by ~2 bps; the macro transmission was the lower realized inflation surprise → higher cut probability → front-end sensitivity and modest yield compression (Fed chatter cited in the snapshot).

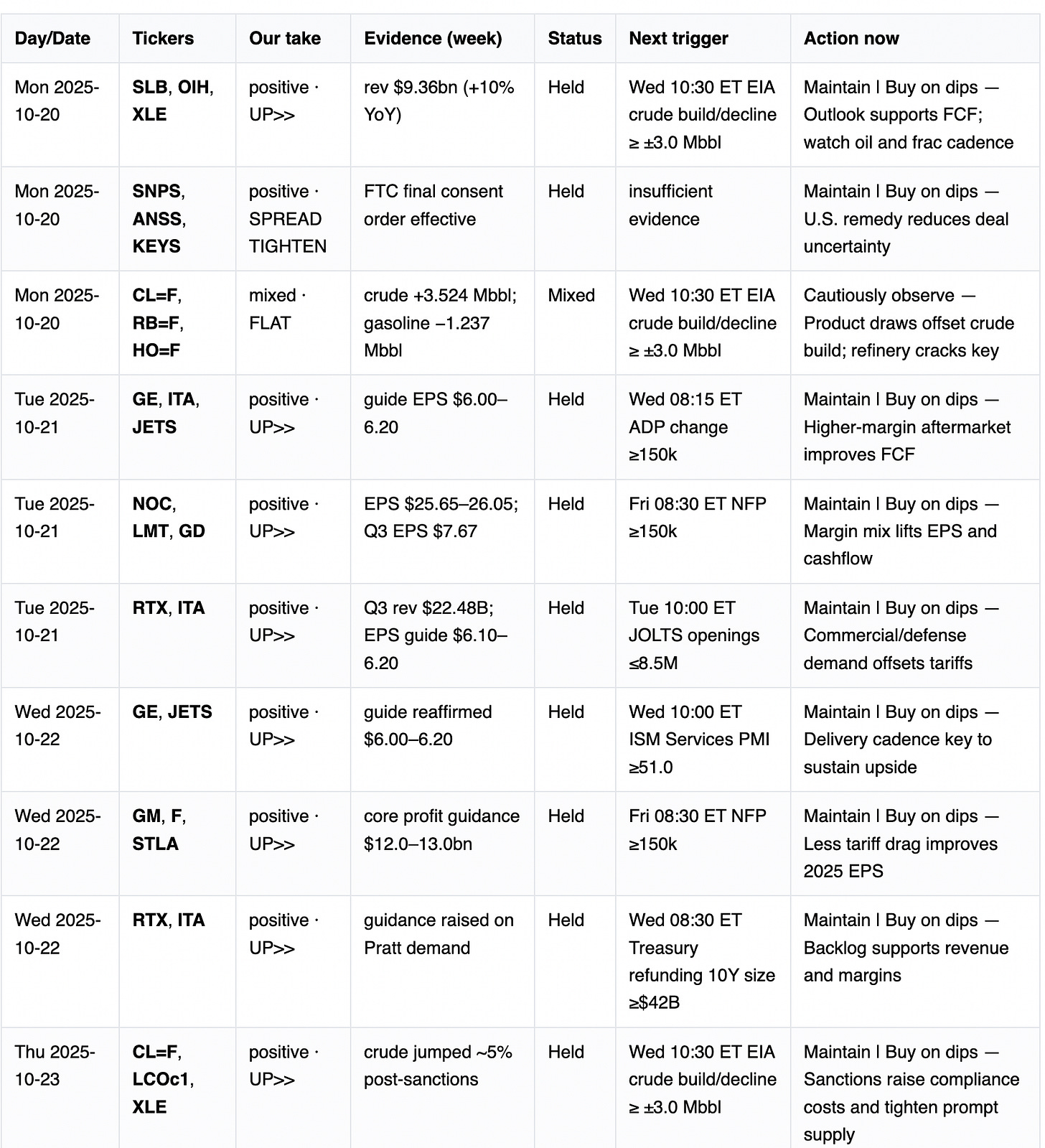

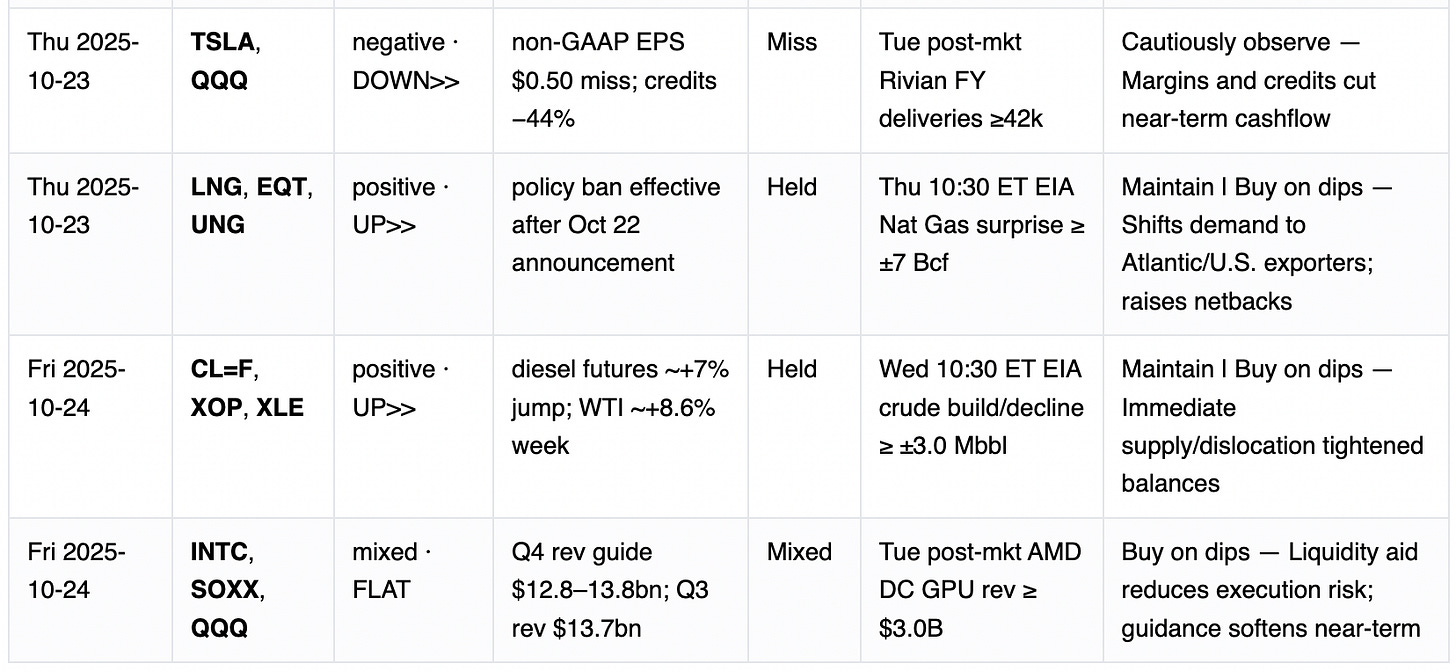

Energy and related geopolitics dominated price moves: front-month WTI rose ~+8.6% to about $61.50 and Brent ~+9.6% to about $65.94 as OFAC sanctions on Rosneft/Lukoil and an EU LNG ban tightened prompt availability and risk premia. Those policy actions — plus Russia’s CBR 50 bps cut to 16.5% noted in the week — raised compliance/friction costs and re‑allocated demand toward Atlantic supply, lifting crude and refined product cracks. Credit and vol reacted modestly (VIX ~16–21 intraday); corporate actions and earnings beats in industrials and aerospace (guidance raises across GE Aerospace, RTX, NOC) provided idiosyncratic support, while notable tech and auto prints (Intel, Tesla) introduced mixed signals for near-term multiples.

Look Into Next Week

Macro Look

Mon–Fri supply/demand and labor prints will likely determine whether this week’s lower inflation reading sustains a dovish repricing or reverses into risk-on spillovers. Key MACRO lines: Mon ISM Manufacturing (PMI ≥50.0), Tue JOLTS openings (openings ≤8.5M), Wed ADP (change ≥150k) and ISM Services (PMI ≥51.0), Wed EIA Petroleum (crude surprise ≥ ±3.0 Mbbl), Thu EIA Nat Gas (surprise ≥ ±7 Bcf), Wed Treasury Refunding (10Y size ≥ $42B), and Fri NFP (NFP ≥150k). If ISM/ISM Services and NFP undershoot these thresholds, front-end cut odds should rise further, pressuring 2Y and supporting equities; a crude draw ≥3.0 Mbbl would sustain energy upside and support XLE/CL=F.

Company Look

Company prints cluster Tue–Thu and will translate guidance into sector flows: Uber (Tue pre‑mkt; rev ≥ $10B), AMD (Tue post; DC GPU rev ≥ $3.0B), Rivian (Tue post; FY deliveries ≥42k), Qualcomm (Wed post; EPS ≥ $2.00), Lyft/DoorDash (Wed post; GBV/GOV thresholds), and Airbnb/Expedia (Thu post; revenue thresholds). Beats that clear posted thresholds should lift sector ETFs (SOXX, XLY) and support Q3-driven guidance revisions; misses, especially on take rates or delivery guidance, will pressure stock-level multipliers and weigh on associated indices.

Triggers

Mon 10:00 ET — ISM Manufacturing PMI ≥ 50.0 → $SPY $DXY $CL=F

Wed 10:30 ET — EIA Petroleum Status crude build/decline ≥ ±3.0 Mbbl → $CL=F $XLE

Fri 08:30 ET — Employment Situation NFP ≥ 150k → $SPY $DXY $2YY